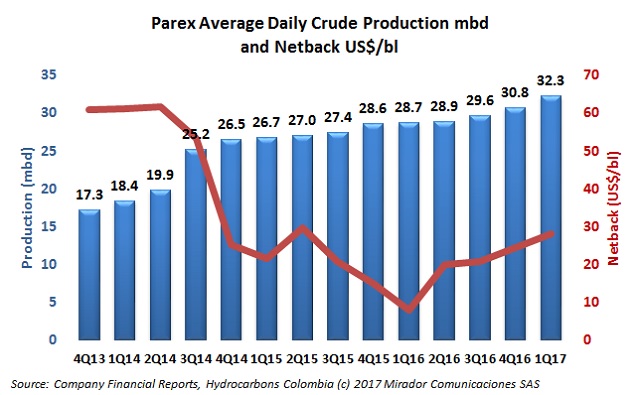

Parex Resources Inc. (TSX: PXT) announced its financial and operating results for 1Q17. The oil firm reported production growth and good financial performance in this period.

A new attack against the NOC’s facilities took place in El Triunfo village, in Acacias (Meta.)

Guillermo Perry Rubio, former MinMinas, talked about the royalties’ model in the country in an interview with Portafolio. He said that the government must make changes to boost the sector and follow the example of other countries in the region.

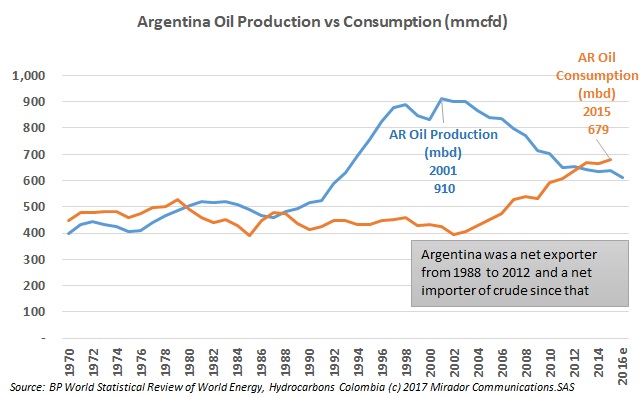

Flights to Buenos Aires are busier lately and the reasons have little to do with soccer, tango or media-lunas. So our readers can understand this phenomenon better, we have a two overview articles.

To accompany Part 1 of our series on the Argentine hydrocarbons industry, we have a number of graphs that will illustrate some of the points.

Canacol Energy could abandon its oil business entirely and concentrate on supplying Colombia’s growing natural gas demand, as the outlook for oil prices remains uncertain.

Ecopetrol (NYSE: EC) presented its first quarter 2017 results. The company had a significant net income increase and good operational performance. The firm is optimistic about this year.

The Union said that it will do whatever it takes to stop Tibu’s hospital privatization, and denounced the fact that Armed Forces ‘violently forced’ protesters to leave CABE’s facilities when they were peacefully demanding a better health system.

Following the announcement of Gorgon, “the biggest gas discovery found in Colombian territory in the last 28 years”, Juan Carlos Echeverry, CEO of Ecopetrol (NYSE: CE) said that despite the fall in oil prices, Ecopetrol’s initial plans are still going strong.

The country’s two most powerful guerrilla groups gathered in Cuba to talk about peace. While the idea sounds convincing and necessary for the development of the two peace processes, the ELN’s actions have shown that their negotiations will not have a happy ending, at least not any time soon.