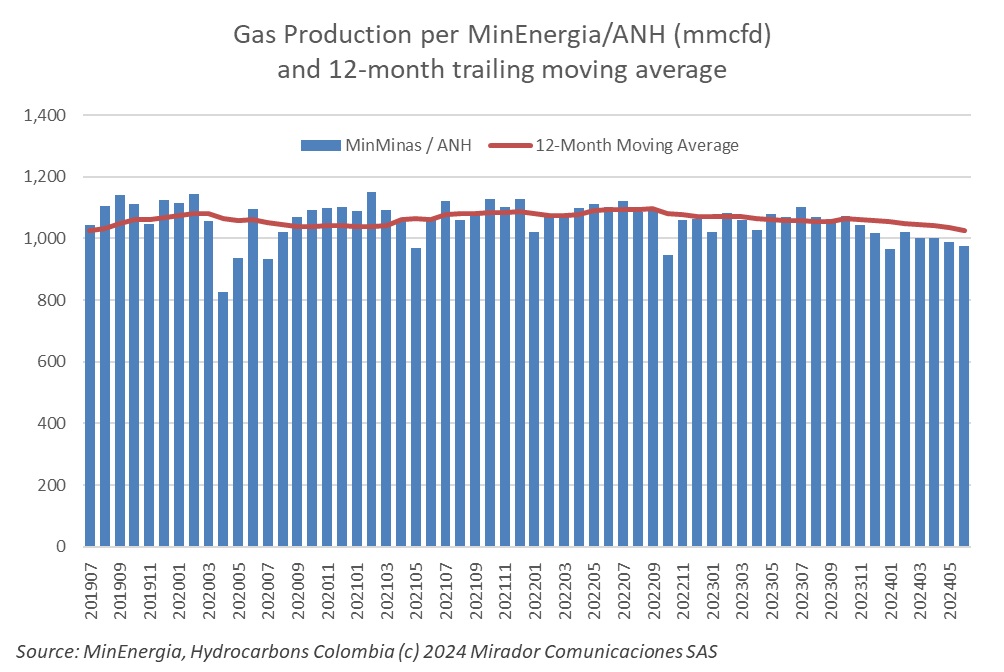

Domestic gas production continues to fall. Apart from a miniscule increase in April, it has declined every month so far this year and June 2024 was 9% lower than June 2023.

Ecopetrol (NYSE: EC) announced that the Uchuva-2 well has confirmed the extension of a gas discovery made in 2022 with the drilling of the Uchuva-1 well.

Cenit, a subsidiary of Ecopetrol (NYSE: EC) dedicated to hydrocarbon transportation, reported a new attack on its infrastructure in Villa López, a rural area of the municipality of San Juan de Betulia, Sucre.

Colombia’s Comptroller General, Carlos Hernán Rodríguez, raised an urgent alarm regarding potential irregularities in the handling of royalties within the country.

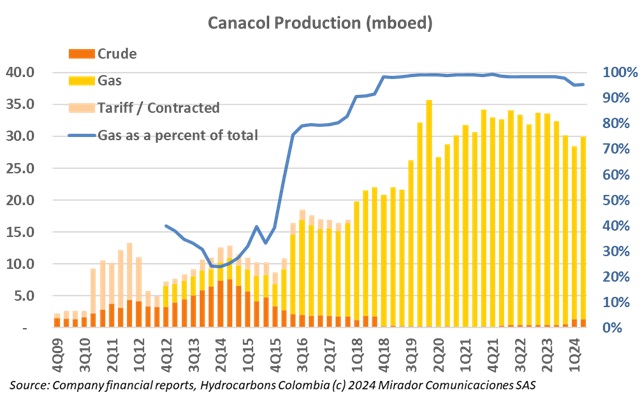

Canacol Energy (TSX: CNE) announced its financial and operational results for the three months ending March 31st, 2024.

In a recent motion of censure debate, Colombia’s Minister of Mines and Energy (MinEnergia), Andrés Camacho, firmly rejected the possibility of importing gas from Venezuela. This stance contrasts sharply with earlier statements made by Ecopetrol’s president, Ricardo Roa, who had hinted at the potential for such imports.

Tomás González, Director of the Energy and Gas Regulatory Commission (Cree) highlighted a concerning trend in Colombia’s gas reserves.

In a move to ensure the efficient management of Colombia’s oil and gas reserves and contingent resources, the Interinstitutional Hydrocarbons Committee will hold its inaugural meeting on August 6, 2024.

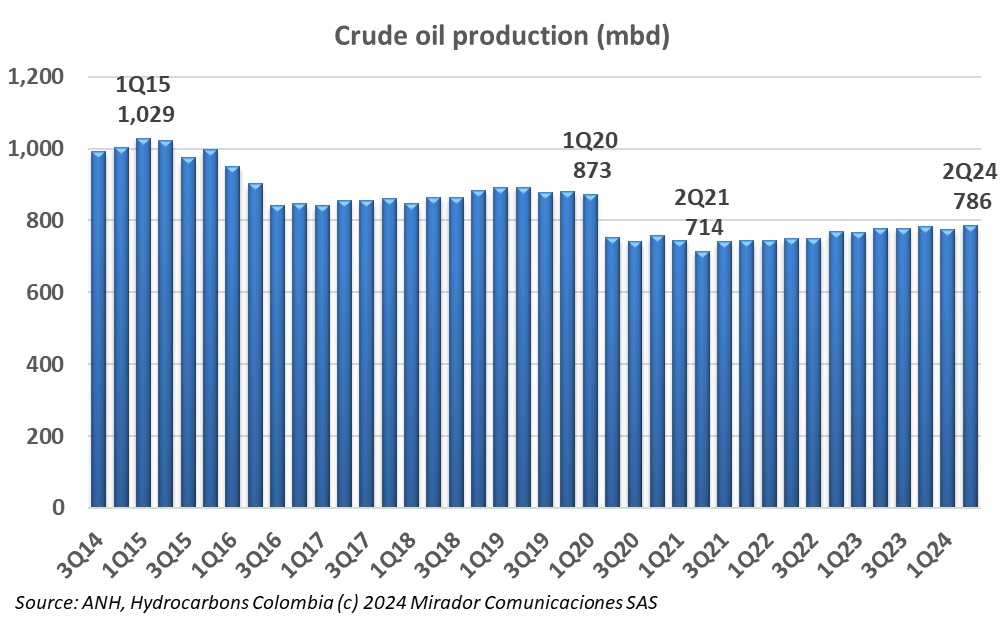

For all the doom and gloom from commentators (like us!) and falling key driver statistics, oil production is up in 2024 versus 2023. Who or what is responsible?

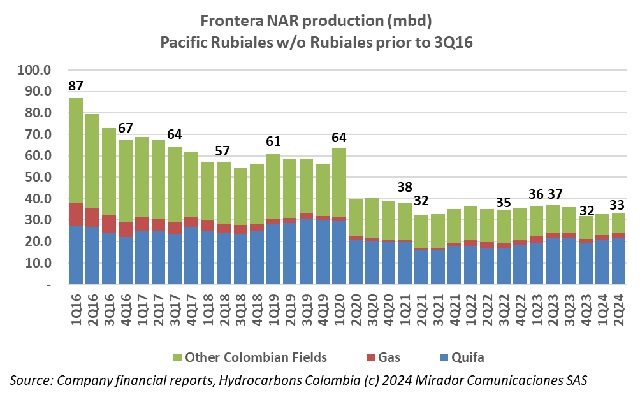

Frontera Energy (TSX: FEC) announced its financial and operating results for 2Q24.