GasThe natural gas industry needs to incorporate 30,000 buses and industrial vehicles to natural gas as a way to advance a more ecological alternative to diesel. This would mean growing the share of natural gas powered vehicles (NGV) to 15% in 10 years, compared to 8% today.

Ecopetrol (NYSE: EC) started the second phase of the socialization process for its Odisea 3D seismic exploration project, holding meetings and environmental workshops in three villages in Casanare. Its seismic exploration in the area has come under fire and been blamed in local press for causing damage to the environment, in particular to rivers.

According to press reports, despite lifting the blockades in the department of Arauca, petroleum operations are still restricted. The protestors understand that holding petroleum operations hostage is the best way to ensure the government actually comes to the negotiating table.

Four congressional representatives in Colombia’s lower house submitted a tax bill that looks to add industry and commerce taxes to extractive industries, arguing that it would benefit municipal entities outside established royalties.

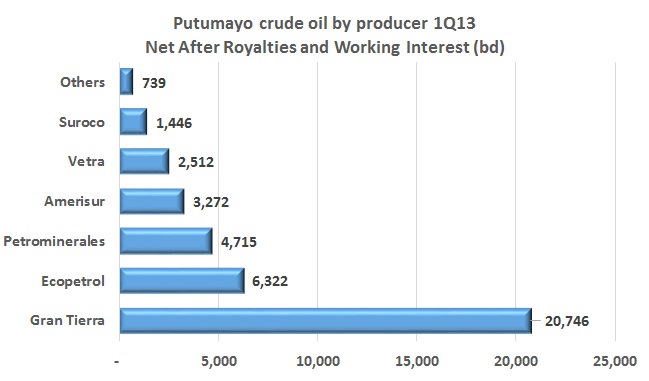

Within this past week, first Suroco (TSX-V: SRN.V) and then Amerisur (LSE: AMER.L) announced that ongoing disturbances in Putumayo had caused the Suroriente block and the Platanillo blocks respectively to be shut in. The graph shows our estimates of companies with crude oil production in the troubled department, using our exclusive database.

This month we have three interviews with important figures in the industry.

The mayor of Puerto Rico, in the Caquetá Department, says that Ecopetrol (NYSE: EC) is ready to start seismic explorations in the area, bringing oil production to the region. But how will this be received by the community?

Ecopetrol’s president Javier Gutiérrez says that the NOC’s refining business is already operating at a lost in some cases and a drop in the final price between CoP$1000-2000 would mean losses for the company around US$1.75B.

The General Royalty System (SGR), through its decision-making body (OCAD) awarded funding to projects on a number of occasions over August. A particular focus was placed on the coffee growing regions, which are at the center of the ongoing national strike. Royalty funds were also addressed by a senator as way to lower fuel prices and offer funds to agricultural sectors as well.

The price of fuel has emerged from the ongoing national strike as a central theme for discord. One proposal is to rehash the formula used to figure fuel prices and reduce taxes. Greater user of pipelines to transport crude also arose as a option.