Colombian senator Jaíme Durán of the Liberal party has called on the leadership of Ecopetrol (NYSE:EC) to explain to the country in detail why the Barrancabermeja project continues to suffer delays.

Mansarovar Energy has abandoned a seismic exploration project near the Villavicencio municipality after opposition from local authorities and community members.

The Colombian Security Council (CCS) says that its Uniform Contractor Registry (RUC) has contributed to a drop in accident over the last two years and also in the severity of the accidents.

Authorities are considering registering two additional properties as nature reserves, one of which specifically to counteract the possibility of more seismic exploration and exploratory drilling, citing the impact on water resources.

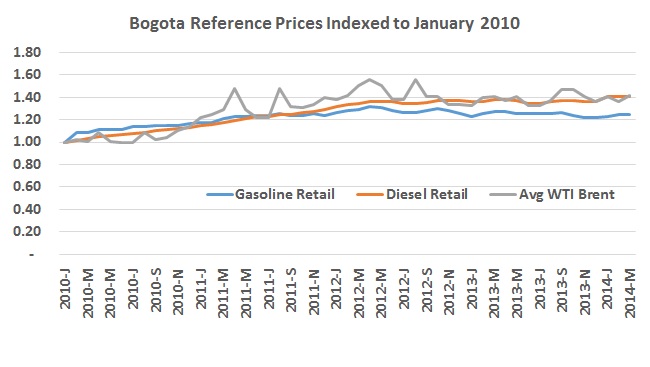

Increases in the WTI oil price and a general trend towards a stronger dollar against the Colombian peso amounts to an increase in gasoline prices this month. Although the government no doubt did what it could to keep them down as the election season heats up.

News of the 250km International Pipeline to connect Colombia to Ecuador’s infrastructure caught Putumayo residents by surprise, and their reactions in local press illustrate the complex challenge which is community and industry relations, and the staunch divisions between regions producing oil and those that watch it pass on the roadways.

Two reports of oil spill have reached local press over the last couple of days, one involving a Perenco owned pipeline in Casanare and the other involving Ecopetrol (NYSE:EC) in Meta.

Colombia’s Minister of Defense Juan Carlo Pinzón has ordered an increase in security measures in Arauca during the run up to elections this Sunday and in light of attacks last week on Unión Patrótica presidential candidate Aída Avella.

GasThe port services holding firm, EL Cayao, of which gas distributor Promigás has a 49.99% share, has won the contract to build a regasification plant for Caribbean thermal energy generation firm Grupo Térmico.

Oil producer Petromont socialized a exploratory drilling project in the Llanos 10 block, where it presented the project to members of 11 villages affected by the drilling in Arauca and Casanare. Environmental authorities were on hand as observers.