The president of the board of directors of the National Hydrocarbons Agency, Alberto Montoya Puyana has resigned from his position, criticizing the policies of President Juan Manuel Santos, which he says have “de-institutionalized” the country.

Colombia’s elections for the Chamber and Senate resulted in nearly balanced figures for the major parties, setting up the need for considerable horse-trading to get legislation passed after the 20th of July when the new Congress starts work.

The USO has a new conspiracy theory and so a new line of accusations against Pacific Rubiales Energy (TSX:PRE). The union is now saying that the firm is looking to take over the Cartagena Refinery (Reficar) project and staff it with Venezuelans.

Incidents near areas of interest to the oil and gas industry were up sharply at 45 above recent and long-term averages. Non-Armed Forces-reported incidents were above average both in percentage and absolute terms. This is our indicator of increased guerrilla-initiated activity. Correspondingly, our 4-week Moving Average incident count was up at 37.5 and the 52 week average was also up slightly at 31.2 incidents per week.

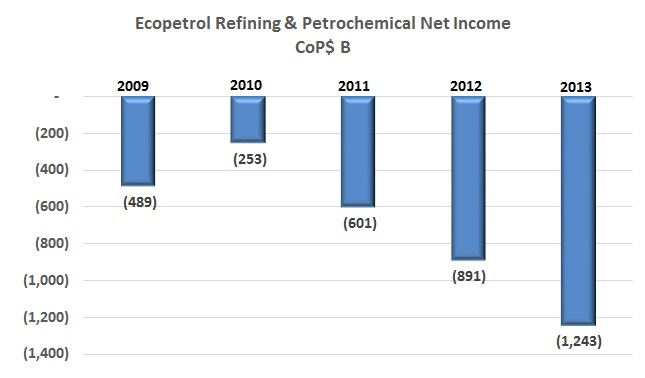

Lately Ecopetrol has received much criticism for the slowness of refinery upgrades in Cartagena and Barrancabermeja. The harder question may be why it is investing at all in this business.

The Inspector General’s (IG) office and the Ministry of Mines and Energy (MinMinas) have halted the awarding of a contract to a consortium led by Promigas to build a regasification plant.

Colombia’s Inspector General (IG) weighed in on the growing list of municipalities that are planning public referendums to approve or reject the extraction of hydrocarbons or minerals in surrounding areas, saying that the use of these resources does not pertain to them.

The Farc’s southern block, considered the more extreme faction within the guerrilla, now has a presence at the negotiating table in Havana through the arrival of Fabián Ramírez.

Colombian senator Jaíme Durán of the Liberal party has called on the leadership of Ecopetrol (NYSE:EC) to explain to the country in detail why the Barrancabermeja project continues to suffer delays.

Mansarovar Energy has abandoned a seismic exploration project near the Villavicencio municipality after opposition from local authorities and community members.