Wednesday, March 4th, 2026

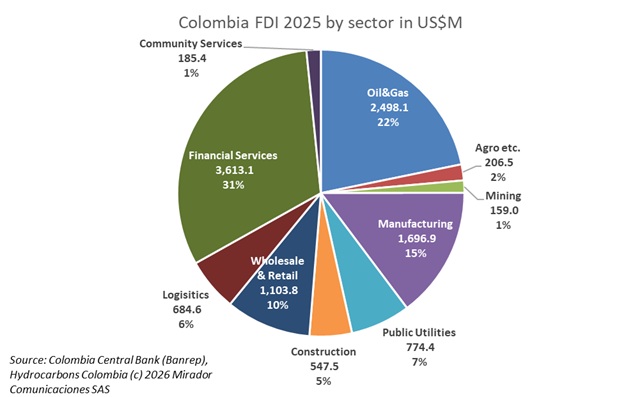

Colombia’s foreign direct investment (FDI) totaled US$11.469B in 2025, representing a 16.1% decline from US$13.684B in 2024 and marking a 33.2% cumulative drop since the 2022 peak of US$17.182B.

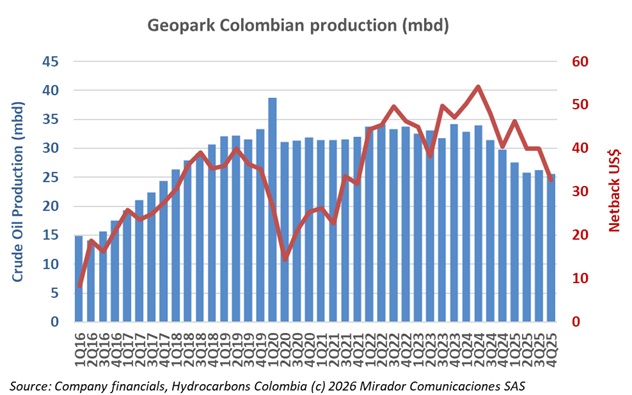

GeoPark says it achieved all key 2025 guidance metrics despite materially lower oil prices, while resetting the portfolio, reset positioning the company for scale and growth. The company characterized 2025 as a transition year executing a strategy of “Protecting What We Have, Returning to Growth.”

Colombia’s petroleum and gas sector voiced strong opposition to the wealth tax imposed under the government’s emergency decrees, warning the measure threatens investment capacity and creates discriminatory tax treatment while failing to account for the industry’s long-term investment cycles.

Canacol announces that the Court of King’s Bench of Alberta (the “Canadian Court”) has approved the Company’s sale and investment solicitation process (“SISP”) authorizing the Company, with the assistance and oversight of the Sale Advisor (as defined below) and KPMG Inc. in its capacity as court-appointed Monitor (the “Monitor”), to implement the SISP in accordance with the approved procedures.

Colombia’s biofuels sector confronts sharply divergent narratives between government policy and industry survival, as President Gustavo Petro defends forced investment reforms while the sugarcane sector warns of imminent operational collapse from excessive imports threatening hundreds of thousands of jobs.

Next Sunday, March 8th, Colombians go to the polls for two separate but related purposes. Roughly half will vote in one of three primary elections for the right (excluding the leading candidate), the left (excluding the leading candidate) and the not-so-left. Perhaps the more important votes will be for Senate and Congress although these get less press coverage.

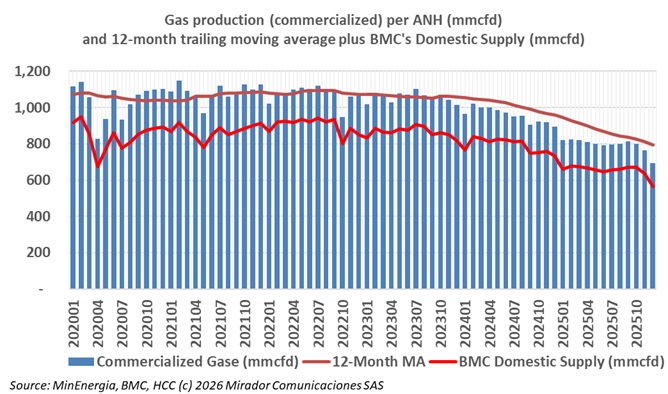

The ANH reports that commercialized natural gas production in December 2025 stood at 692.91 million cubic feet per day (mcfd). This monthly variation does not compromise the country’s energy security nor is it due to public policy decisions by the national government.