Following the announcement by Colombia’s National Administrative Department of Statistics (DANE) that the country’s GDP grew by 2% in the third quarter—falling short of market expectations—leading business figures have voiced concerns over the sluggish recovery of key economic sectors.

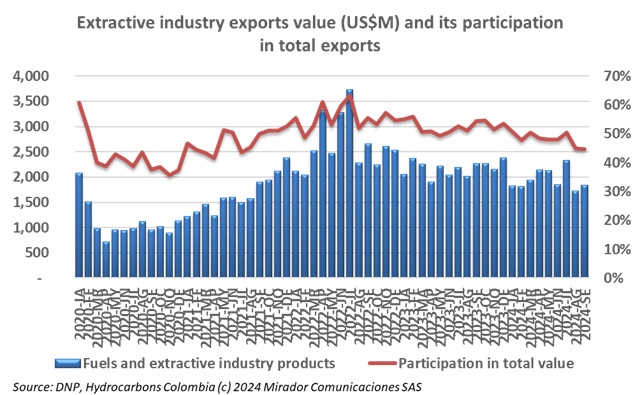

The National Administrative Department of Statistics (DANE) reported the value of Colombian exports during September 2024.

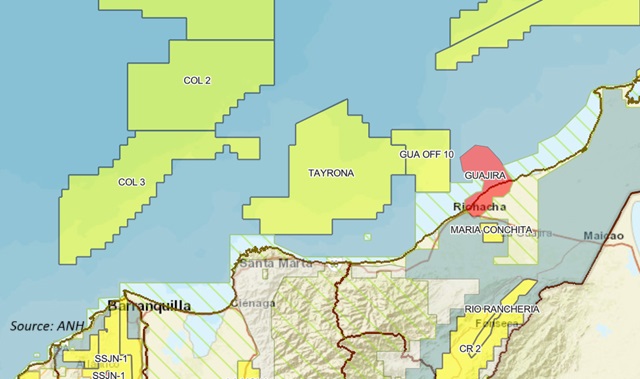

I was using the ANH’s online georeferencing tool the other day and started playing with the slider that shows the “mapa de tierras” for different time periods. That got me thinking about how the map had evolved over time and what that might say about the ANH.

During COP16, Colombia’s Ministry of Mines and Energy (MinEnergia) reaffirmed its commitment to sustainable mining practices by launching a “Joint Voluntary Declaration on Responsible Mining Practices for the Protection of Life and the Environment”.

Alejandro Castañeda, President of the National Association of Power Generators (Andeg), talked about the role of the private sector in averting gas rationing.

The Ministry of the Interior (MinInterior) launched a free, self-managed virtual course on the right to prior consultation, available to Indigenous, Rom, Afro-Colombian, Raizal, and Palenquera communities, as well as the public.

The recent government announcement about “planned gas rationing” in Colombia sparked concern, yet officials are clarifying the situation.

A Colombian tribunal revived the drilling of Uchuva 2, a critical natural gas well, while mandating consultation with Indigenous communities in Taganga, Magdalena, who may be affected by the project.

The Colombian Chamber of Petroleum, Gas, and Energy Services (Campetrol) has highlighted a key issue stalling the country’s oil production growth: blockades and public order disruptions.

In a recent address at the OAS Inter-American Conference of Labor Ministers, Colombian President Gustavo Petro reiterated his stance against new oil and gas exploration contracts.