Time is up on a 90-day period given by the Ministry of Mines and Energy (MinMinas) to local municipalities and districts to present details of protected areas, with authorities and advocates questioning the timing and reach of the decree.

Following a meeting between the USO oil workers union president Edwin Castaño and a number of government ministers, vice ministers and the head of the National Planning Department (DNP) Simon Gaviria, the union said that it would not hold an indefinite strike after Gaviria made statements that Ecopetrol would not be privatized.

The Colombian Petroleum Association (ACP) has again called on the government to take immediate action to avoid that more exploration projects are shuttered or halted.

Mauricio de la Mora has been confirmed as the new president of the National Hydrocarbons Agency (ANH), replacing Javier Betancourt and taking charge of the agency at a fragile moment for the industry.

The political forces that successfully swayed Ecopetrol’s (NYSE:EC) board to not renew the association contract with Pacific Rubiales (TSX:PRE) have moved on to the next step, that Ecopetrol operate the field directly, opening the door to the USO union to enter the field.

As the debate on the the National Development Plan for the next four years starts in Colombia’s congress, the Minister of Mines and Energy (MinMinas) Tomás González has made another public appeal for flexibility for companies in the oil industry, considering the price crisis.

The Ministry of Mines and Energy (MinMinas) is advancing with a resolution that would rework how territorial entities share royalties of projects on properties which overlap regional borders, introducing a new formula.

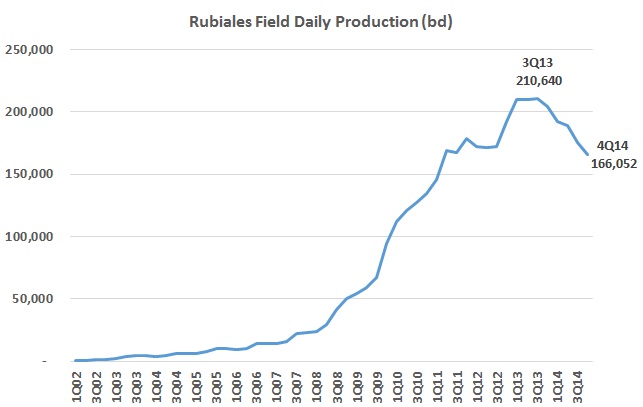

The graph shows what has happened to production from Rubiales field since 2002. Meta Petroleum i.e. Pacific Rubiales (TSX:PRE) took over operations of the field in mid-2006 when it was producing just under 10mbd by our estimates.

The association of propane gas distributors Gasnova reiterated its alarms that Ecopetrol (NYSE:EC) is taking measures to limit the supply of propane gas in Colombia to benefit its financial results, which it says will have a grave impact on the poorest populations in the country.

The Minister of Environment Gabriel Vallejo contests the concept of ‘express’ environmental licenses, arguing that instead the license only now has clear procedures and timeframes, and the new system will be technical and more formal.