Hydrocarbons Colombia was present at a Campetrol-organized conversation on the peace agreements. We brought back a brief overview of the talk.

The board of directors of the USO oil workers union said that problems in creating a dialogue with Ecopetrol (NYSE:EC) have led it to convoke a general strike of the NOC’s direct and contract workers. The union claimed the strike is necessary to avoid the privatization of Ecopetrol.

The Finance Minister Mauricio Cárdenas said he has a “shock plan” ready for Ecopetrol (NYSE:EC) which is designed to increase production by 25,000bd and improve the country’s macroeconomic benchmarks.

After a hearing ordered by the municipal council of Simacota, Santander, Ecopetrol (NYSE:EC) and Parex Resources (TSX:PXT) have clarified that the participation agreement and nearby project does not involve any unconventional techniques like fracking

Ecopetrol (NYSE:EC) said that more than 40,000bd of crude production is at risk due to striking coca farmers in Puerto Caicedo, Putumayo.

The final stretch is underway to close and approve via plebiscite the peace agreement reached between Farc and government negotiators. The date for the signing of the agreement and the critical plebiscite to pass it are now official as well.

Pending changes which will be announced by the Energy and Gas Regulation Commission (CREG) between October and November could mean lower biofuels rates, which has producers concerned.

The Barranquilla Chamber of Commerce sees bright opportunities for the region with an increase in the number of companies interested in locating in the region, and from a wide variety of disciplines. But offshore activity could prove to be key source of growth for the region and attracting new firms is an important part of its strategy.

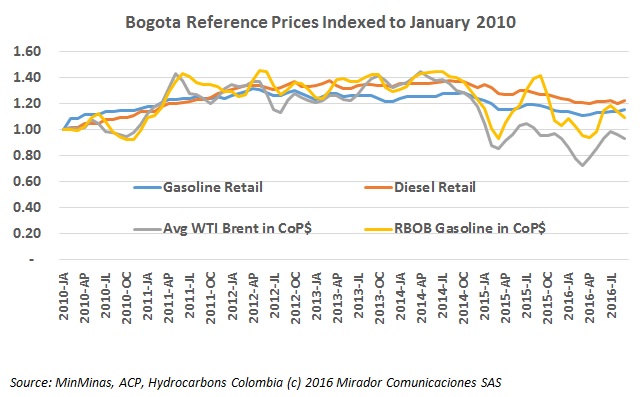

The Ministry of Mines and Energy (MinMinas) published fuel prices over the weekend for September 2016, which include an rise in both gasoline and diesel, citing increases in crude and biofuels prices.

The Colombian Petroleum Association (ACP) called the peace agreement a positive development and recognized the government’s effort to achieve it. In its diplomatically-toned declaration, it says it will analyze the agreement for its opportunities and challenges.