Colombia’s Comptroller General has identified 14 findings totaling CoP$78.8B in projects financed through the General System of Royalties (SGR), exposing serious flaws in initiatives across technology, science, energy, housing, and transportation.

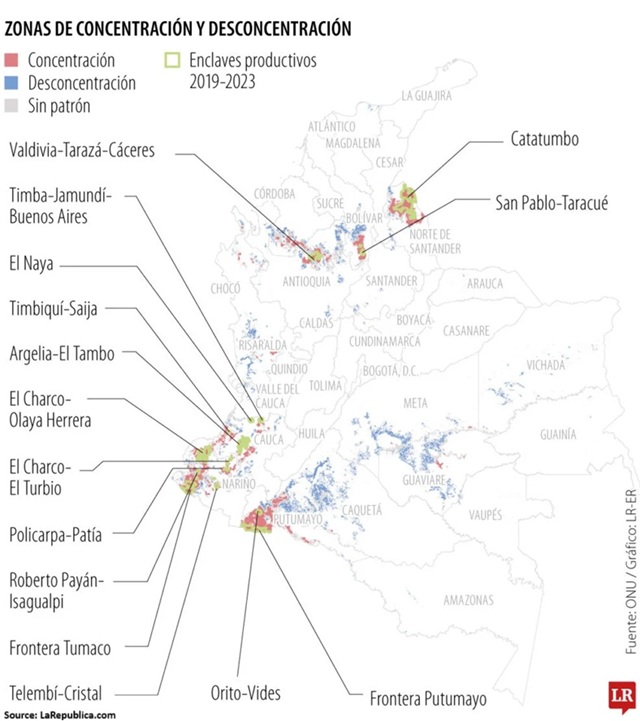

Colombia’s business community has voiced alarm over the U.S. government’s decision to decertify the country in its anti-narcotics efforts, warning that the move could erode investor confidence, weaken the peso, and strain bilateral trade ties.

Colombia risks losing CoP$38T (US$9.5B) and up to 74,000 jobs if the country proceeds on its energy transition without a clear and orderly strategy, according to a new report by the National Federation of Coal Producers (Fenalcarbón) and the Regional Center for Energy Studies (Cree).

President Gustavo Petro’s government introduced its third tax reform, once again tightening fiscal pressure on Colombia’s oil and coal producers.

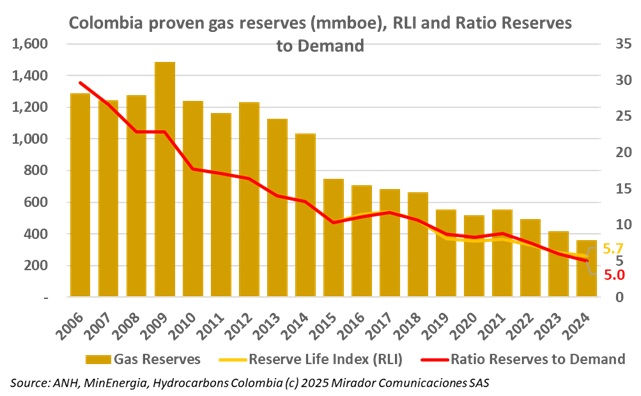

Colombia has revived a politically charged idea: importing natural gas from Venezuela before year-end.

Coviandina, the Bogotá–Villavicencio concessionaire, confirmed a total closure on the old Llanos road to carry out improvements between kilometer points K18+340 and K18+980.

Colombia’s energy transition is colliding with regional economics, as a new report by the National Federation of Coal Producers (Fenalcarbón) and the Regional Center for Energy Studies (CREE) warned that an accelerated coal phase-down could trigger severe social and fiscal shocks in mining territories.

At the 2nd Offshore Caribbean Forum: Energy and Progress, Ecopetrol’s General Manager for Offshore and Exploration, Elsa Jaimes, outlined the regulatory, technical, and institutional challenges Colombia must address to advance natural gas exploration and production in the Caribbean Sea.

The Colombian Ministry of Finance (MinHacienda) proposed tax reforms that would significantly increase the fiscal load on the hydrocarbons and mining-energy sectors, aligning with the government’s push for renewable energy transition.

Mónica de Greiff, chair of Ecopetrol’s (NYSE: EC) Board of Directors, ruled out the possibility of Colombia importing natural gas directly from Venezuela, citing U.S. sanctions.