The Ministry of Mines and Energy (MinMinas) reported gas production figures for January 2019. Natural gas has been showing a positive performance in recent months.

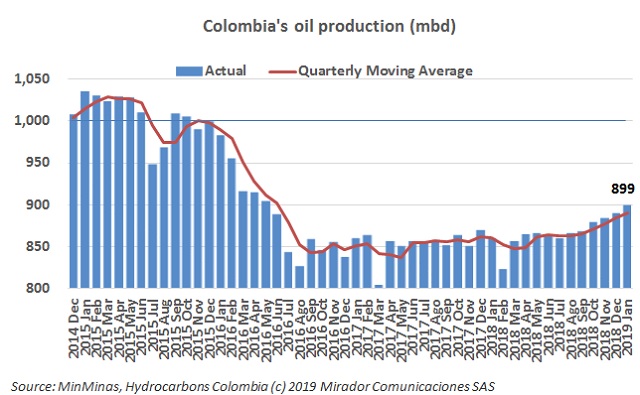

The Ministry of Mines and Energy (MinMinas) reported oil and gas production figures for January 2019. Crude and natural gas production grew in the first month of this year.

The long-awaited report of the commission of experts was presented to the public Thursday afternoon. We attended. The study concluded there was much opportunity but much uncertainty so the country should run a pilot. Which is what Ecopetrol had proposed last year.

President Duque promised to encourage the growth of the extractive sector in Colombia. The Ministry of Mines and Energy (MinMinas) published a project with the guidelines and budget to achieve it.

The Ministry of Mines and Energy (MinMinas) spoke about new regulations and why they will boost Colombia’s development this year.

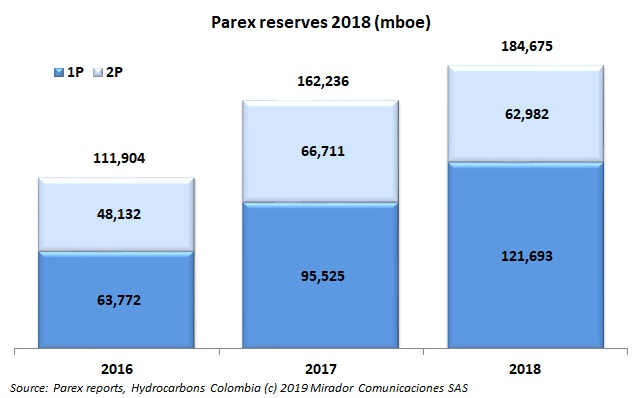

Parex Resources Inc. (TSX:PXT) announced its annual reserves as at December 31, 2018. The company pointed out that its proved reserves (1P) increased compared to the previous year. PXT recalled that its reserves are located in Colombia’s Llanos and Middle Magdalena basins.

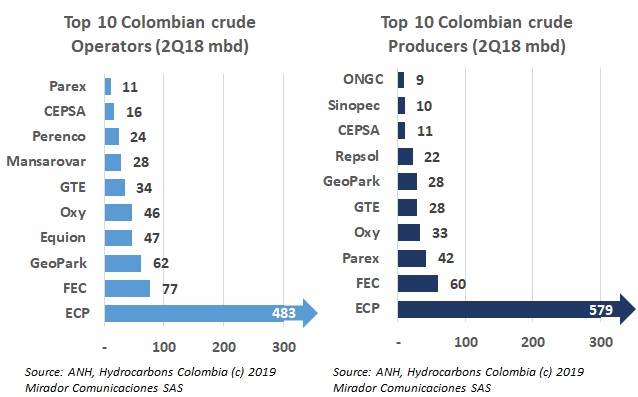

Oil production in Colombia showed stable performance throughout 2018, but the National Hydrocarbons Agency (ANH) has not reported information per field for the last two quarters of the year. However, the agency recently reported 2Q18 figures per field and we updated our database to analyze oil companies’ production metrics.

Gran Tierra Energy (TSX: GTE) announced its 2018 year-end estimated reserves as evaluated by McDaniel & Associates Consultans Ltd. The firm reported its estimated prospective resources as well. GTE production increased in Colombia.

Ecopetrol’s (NYSE) CEO, Felipe Bayón, spoke about the importance that fracking has for Colombia in a scarce oil environment.

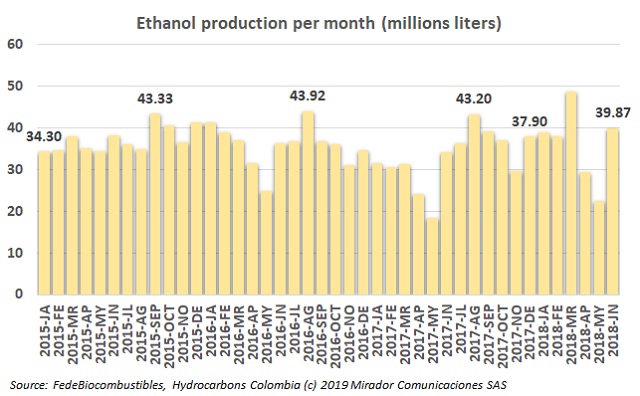

Walfredo Linhares, CEO of Bioenergy, spoke about the company’s ethanol production expectations for the coming years. He highlighted the relevance of the production plant located in the department of Meta.