The Colombian Chamber of Petroleum Goods and Services (Campetrol) brought authorities and industry representatives together, to analyze the sector’s territorial strategy. Here are the details.

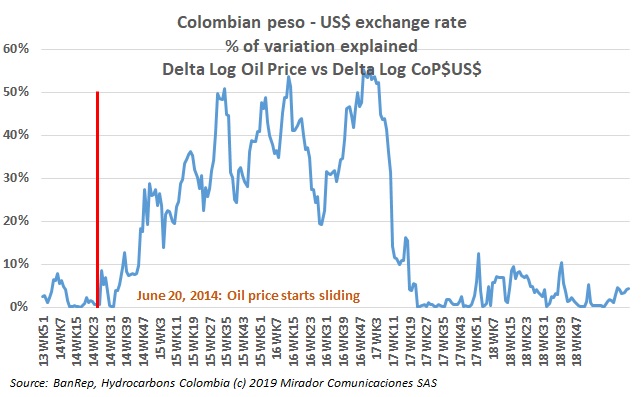

The Colombian peso has devaluated strongly against the dollar in recent months, causing concerns in some economic sectors. Juan José Echavarría, Manager of the Colombia’s Central Bank (Banrep), spoke on this subject.

The government presented the National Development Plan (PND) but some of its articles have generated much controversy. The Association of Financial Institutions (ANIF) spoke about the PND and some of its effects on fuel prices.

Colombia could see an increase in its oil revenues, if Brent prices stay at US$74, Acciones & Valores said.

Entrepreneur Mauricio Botero wrote an Op-Ed explaining why selling part of Ecopetrol (NYSE:EC) to finance infrastructure projects is the way to go.

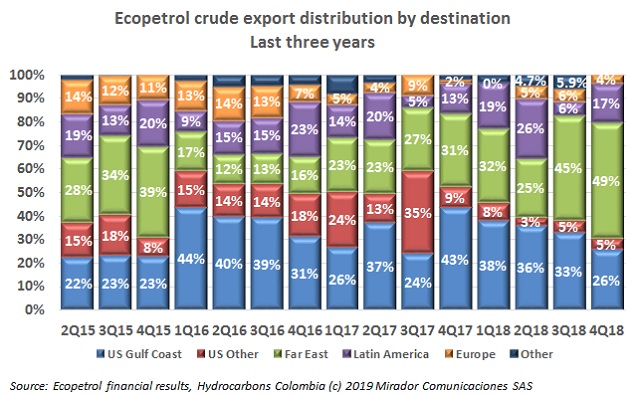

The crisis in Venezuela opened the possibility of increasing oil exports from Colombia to the United States, generating great expectations in the sector. However, Moody’s made a report on this situation, and the results are not very encouraging.

The government had announced the possibility of selling 8.5% of Ecopetrol’s (NYSE:EC) shares. The Association of Financial Institutions (ANIF) has plans for the revenue this might generate.

Although the industry’s situation in Colombia is still quite complex, the Executive President of the Colombian Chamber of Petroleum Goods and Services (Campetrol) Germán Espinosa, was optimistic about the future of the sector in the country.

The Colombian oil sector has been key for the country’s economy, but its future is uncertain, as popular referendums and social unrest are putting its development at risk. Sergio Cabrales Arévalo, Doctor and Researcher in Administration of the Andes University, made an analysis of the sector’s future.

Antoine Halff, researcher at the Center for Global Energy Policy at Columbia University and former lead analyst for the International Energy Agency (IEA), spoke about the situation of the industry in Colombia.