As Colombia enters a decisive week for its energy sector, industry leaders are sounding the alarm: the choices made today will determine the nation’s energy stability for decades.

Global oil markets are heading toward a potential glut, as production rises faster than demand over the next two years, according to the International Energy Agency (IEA).

The much-repeated claim that the world has reached its “peak fossil fuel demand” may sound reassuring, but it’s a misconception that, according to Aquiles Mercado González, Financial and Administrative Vice President of Promigas, borders on self-deception.

Recent developments in Colombia highlight growing discontent among mining communities and labor unions over the government’s energy transition agenda, particularly its stance on coal production and exports in La Guajira and Cesar.

The Amazon presidential summit in Bogotá closed with partial agreements but without the headline demand from Indigenous communities, scientists, and civil society: a ban on fossil fuel extraction in the rainforest.

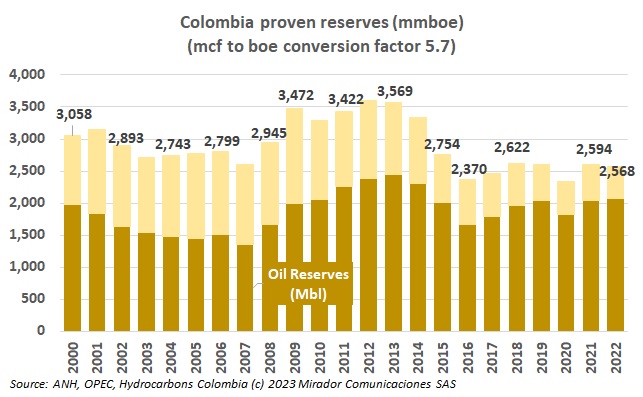

In a sharply worded opinion piece, Aquiles Mercado, Vice President of Finance and Administration, warned that Colombia may be falling into what he calls “Energy hubris”, an arrogance that could cost the country its energy sovereignty.

The president of Colombia’s oil workers’ union, Unión Sindical Obrera (USO), César Loza Arenas, called on Ecopetrol (NYSE: EC) to step up exploration of oil and gas in the country, warning that the state-owned company cannot wait until “the pot is scraped clean.”

The agricultural sector emerged as one of the key drivers of Colombia’s economy in 2024. By the third quarter, it was the fastest-growing sector, expanding at an annual rate of 10.7%. After coffee, which had an exceptional year, permanent crops such as sugarcane showed the highest growth.

Women in Mining Colombia (WIM) recently expressed their deep sorrow over the passing of Marianna Boza, a leader who championed gender equity and promoted the extractive industry in the country.

Swedish activist and academic Andreas Malm made a bold proclamation during a conference in France over the weekend, predicting the demise of Colombia’s oil industry within a decade.