Too much time on my hands during the Easter break, too much Janice Joplin and too much thinking about the Constitutional Court had definitely brought me down.

Colombia’s highest court has been very active lately, deciding on a number of community rights issues in a way that makes it difficult to plan long-term projects.

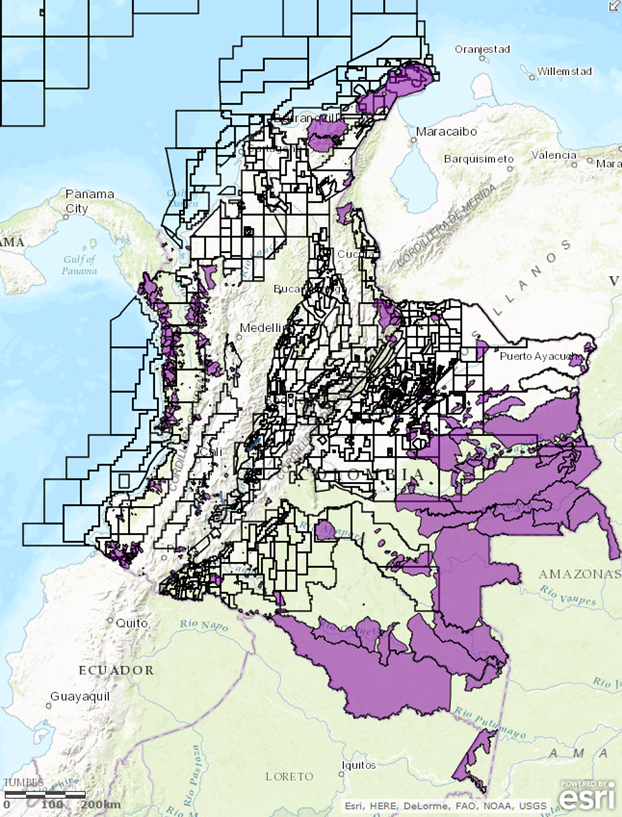

The Constitutional Court has said that the definition of ‘zone of influence’ that MinInterior has been using to determine if indigenous communities need to be consulted is too restrictive.

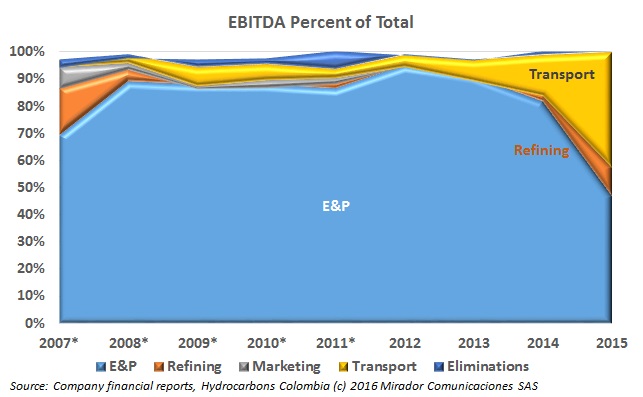

Ecopetrol (NYSE:EC) published its results this week and that allows us to update our analysis of the NOC by Line-of-Business (LOB). By now it should not be a surprise that the Transport division is ‘carrying the load’ for other, weaker LOBs.

We had been saying that a number of the ANH’s recent initiatives were more likely to produce gas rather than crude oil.

It will not be official until May 2016 but with Ecopetrol’s reserves announcement this week, it seems to us that Colombian oil reserves will drop over 10% to something under 2,100 mmbl.

Discussions between OPEC and Russia on reducing production have borne some fruit. The graph shows weekly closing prices for Brent and WTI during the past year.

Editor’s Note: David Yanovich is a Colombian consultant and investment banker who has been part of the Hydrocarbons Colombia community since the very beginning.

Last week we asserted that Naturgas president Eduardo Pizano was incorrect when he said that there was enough gas to meet demand and that El Niño had only caused the “feeling of shortages”.

The Energy and Gas Regulation Commission (CREG) is charged with regulating the industries with the closest impact on the average consumer, electricity and natural gas, and the markets which supply these services.