As I told you last time, we are preparing a book so I needed to reread all our weekly summaries about the FARC peace process. It was interesting to see what had changed, what was still an issue, what we thought was important from reading the Colombian press and what I had expected to be important, but which got very little attention. Here I look deeper into the topics we covered and what they might mean.

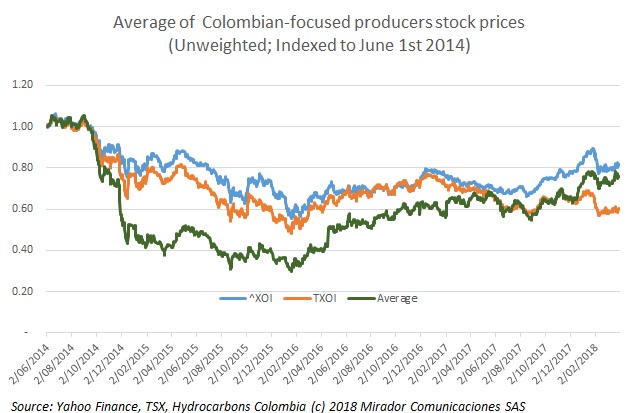

After years of underperforming global indexes, Colombian-focused companies finally caught one: the TSX’s index of Canadian oil and gas stocks.

We are preparing a book (our first!) so I needed to reread all our weekly summaries about the FARC peace process. It was interesting to see what had changed, what was still an issue, what we thought was important from reading the Colombian press and what I had expected to be important, but which got very little attention.

Normally, the catch-phrase “Quiet. Too quiet” is a foreboding of something bad about to occur. But now it looks like this quiet security period will extend a long time, maybe as the ‘new normal’. Originally, we published this report weekly. Then we dropped to monthly and then quarterly, then only when there was something interesting to say. This quarterly article shows very little has changed or is likely to change. For that reason, we have decided that this is our last report.

Collaborator Tomás de la Calle volunteered to go to Cartagena for the annual natural gas sector conference. Here is his report on the event and, as an extra bonus, his opinion about the UPME’s second re-gasification plant project and stimulating domestic exploration and production.

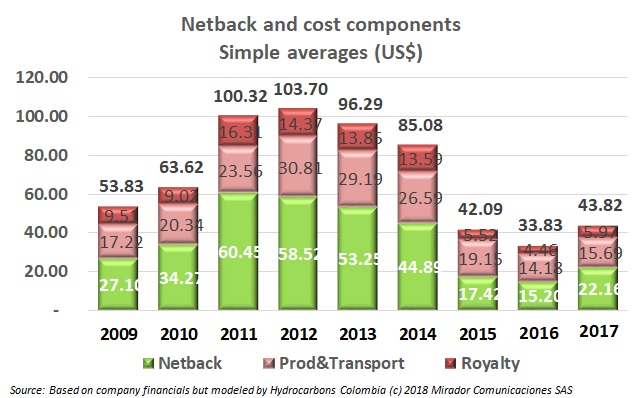

Financial results for 4Q17 are in and crude oil netbacks are up. Hardly surprising given the run up in oil prices, but it looks like not all the growth in Brent is passing through directly to operating profitability.

Since we started Hydrocarbons Colombia, we have reported on a number of good-sized scandals, ones that have lasted more than a couple of days. The latest is the escape of oil from the La Lizama well. This one could have more profound impacts on the industry than any previous media circus.

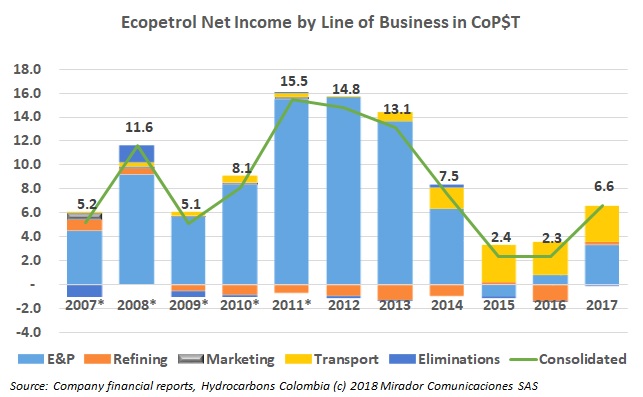

Ecopetrol (NYSE:EC) is unique among Colombia-focused operators for many reasons but one is that it is the country’s only integrated oil company, lacking just retail distribution for it to cover the entire value chain. Luckily, the NOC publishes results by Line of Business (LoB) that allow us to understand what is happening below the top-line.

This past week, ANH head Orlando Velandia reiterated 900 mbd as his 2018 target for crude oil production. Unfortunately, February production also came out this week and that was only 823 mbd. Recently, I came across an article we wrote just over a year ago (late January 2017) and we seem to be in exactly the same spot we were then.

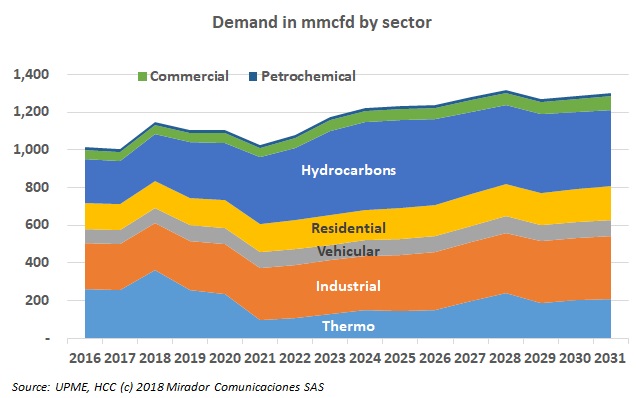

Just over a month ago we looked at the UPME’s latest demand forecasts, focusing on the potential supply shortfall. This time, we look a little deeper at demand especially where it comes from, both in terms of sector and region.