There was some suspense but, in the end, no surprises: right-wing candidate Iván Duque will battle left-wing candidate Gustavo Petro in the second round of Colombia’s presidential elections on June 17th.

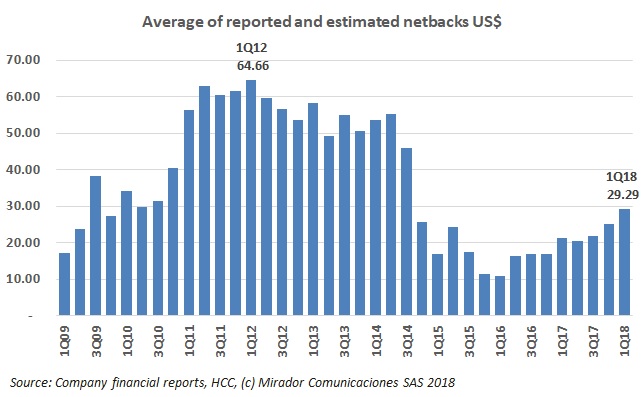

Now here is a little-known fact: higher oil prices lead to better netbacks! OK so it is painfully obvious. Welcome… but painfully obvious none-the-less.

The Works-for-Taxes program is one of the most interesting ideas by the Colombian Government that we have seen in a long time. It is long-established in Peru and companies that saw it work there have advocated for its adoption in Colombia.

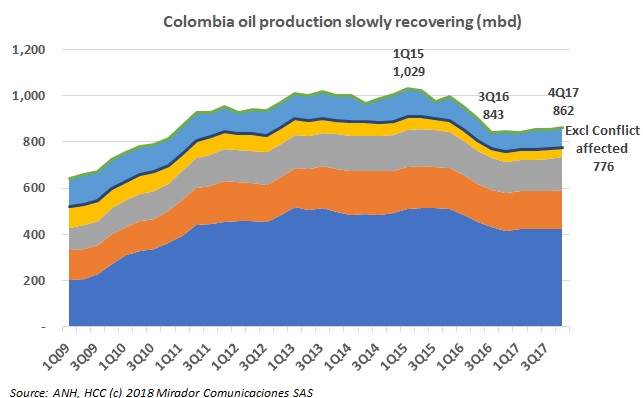

Finally, the ANH published detailed, field-level results for 4Q17 so we can do our quarterly ‘Winners and Losers’ analysis. As always there was much individual variation, but winners tended to be larger than losers, hence our title.

This will be published on Monday May 14, a Colombian holiday (Ascension Day if you are curious) and the start of the final push for Colombia’s Presidential elections (on May 23rd). Two weeks from today we should have significantly more clarity on the next Government and so significantly more clarity on oil policy for the next four years.

We are only publishing Ecopetrol’s (NYSE:EC) overall results today but we thought we would get a jump on the analysis by publishing the NOC’s Line of Business results simultaneously.

There was a 50’s game show called ‘Truth or consequences’ and I was reminded of it while reading this week’s announcement on reserves.

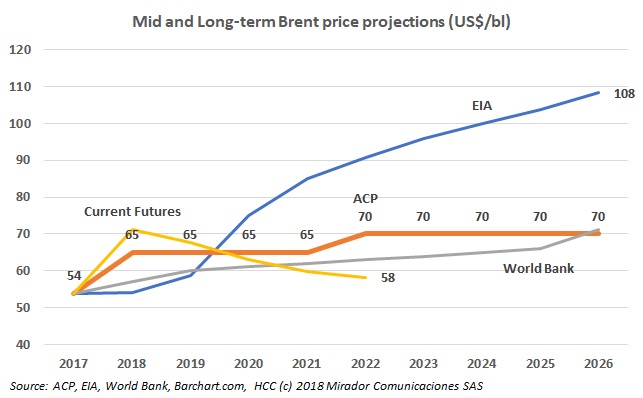

Recently the ACP announced its long-term price forecasts out to 2028. They also compared their numbers to other, publicly-available projections. We provide our own version of the comparison graph, translate some of the ACP’s commentary and give some of our own.

As I told you last time, we are preparing a book so I needed to reread all our weekly summaries about the FARC peace process. It was interesting how momentum had ebbed and flowed during the nearly five years of the process. In this final installment, I focus on that momentum and the important turning points.

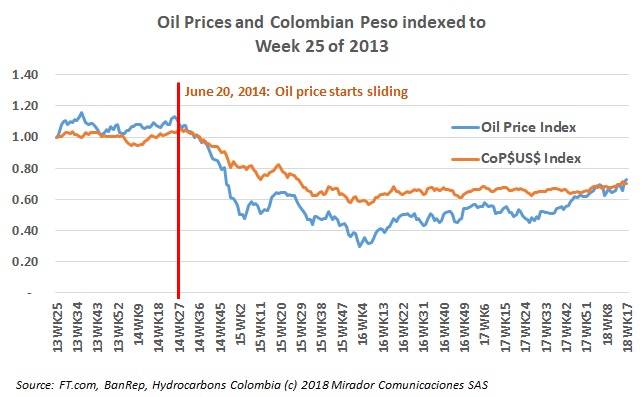

The HCC Analyst was concerned to see his graph of oil prices and the Colombian peso / USD exchange rate used in Friday’s newsletter without – in his opinion – the proper caveats. He demanded time to explain what was happening more carefully. (We think deep down he did not have anything else prepared, but we do agree that Friday’s article glossed over some important points.)