We have been very concerned about the civil disobedience caused by the ANH’s seismic investigation in Boyacá. There was a public hearing last Friday to discuss the situation and well-known industry figure, Jaime Checa attended. He brought back this report (with photos) which only deepens our concern.

BP recently published its annual statistical summary of the global energy market and we thought it might be interesting to look at a few selected charts. The focus was country-by-country comparisons and, by looking at energy consumption broadly, we chose some variables that might be a bit different.

Recently, we published an article about the mining industry in Cundinamarca. The departmental Controller was concerned that environmental licenses were not be properly monitored. A reader reacted to the article with an interesting recommendation and that got me thinking about the challenges of implementing it.

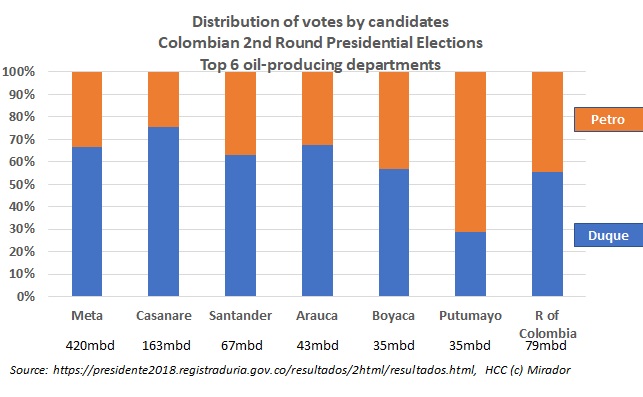

The second round of Colombia’s Presidential Election is over and, as we reported in our newsletter today, Iván Duque will be the country’s next President. See our analysis article for what that will mean for the oil and gas industry. As before, we wanted to see how the top oil-producing departments behaved.

As the polls predicted, the Centro Democrático’s candidate, Iván Duque, won the Colombian Presidential elections and will be sworn into office on August 7th. Investors breathed a collective sigh of relief. Had his opponent, Gustavo Petro, won, uncertainty would have increased considerably.

About a month ago, one of the country’s leading business newspapers, published an article on Ecopetrol’s (NYSE:EC) results with the brilliant title “Ecopetrol does not give up its position as the leader in hydrocarbons”. Considering that the NOC produces ten times what the next company does this does not show a lot of insightful analysis on the part of the headline writer.

Raul Gallegos is Control Risk’s Associate Director based in Bogotá and he keeps an eye on extractive industries. Here he addresses the challenge of royalties in the context of social conflict and with the backdrop of the upcoming Presidential Elections.

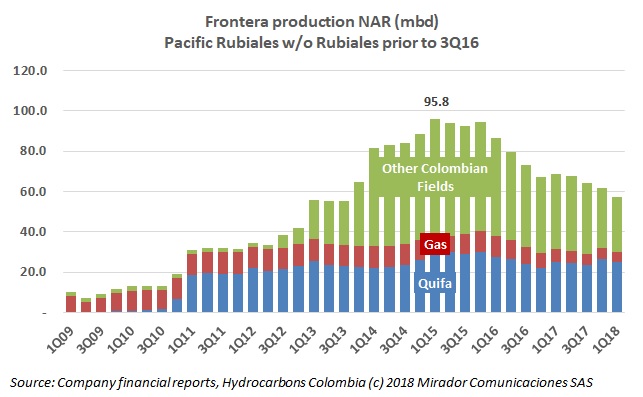

While reporting on Frontera’s (TSX:FEC) results, we realized that we were continuing to tell an old story. It was time to tell Frontera’s story not one from the past.

As I said a few weeks ago, we are rereading / reediting / rewriting the peace-process summaries that we wrote from 2013 through mid-2017. A frequent writing error was to confuse singular and plural when referring to the FARC; ”the FARC is” versus “the FARC are”. I was reminded of this problem when reading our recent security summary.

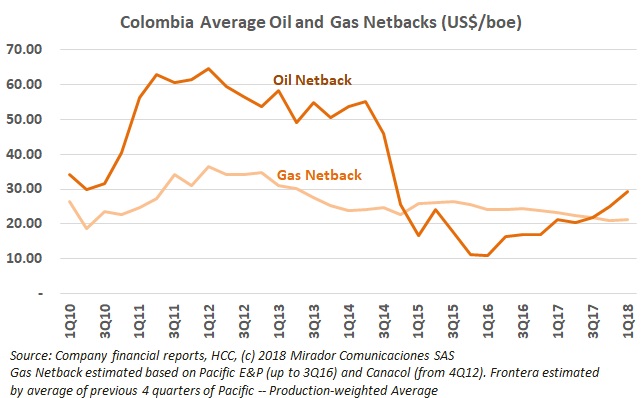

Higher oil prices have knocked gas off its perch as Colombia’s most profitable hydrocarbon, at least on a netback basis. We update our charts with the results of 1Q18 and comment about what this shift might mean.