One of the hardest editing problems I have occurs whenever we have to write about security issues associated with former Farc guerrilla. The problems occur because of differences between Spanish and English, but mostly because of a ‘what-do-we-call-them’ issue. However, the real security issues are far bigger than any language challenges we might have.

Our Analyst complained that we had taken his usual space in the newsletter for our various end-of-Santos-government reviews. (Normally he complains because he has no idea what to write about come the Friday deadline, so this was a first.) He was especially concerned because he had good news to report.

This week the Duque government’s new hydrocarbons team was finalized. What will they do? What should they do?

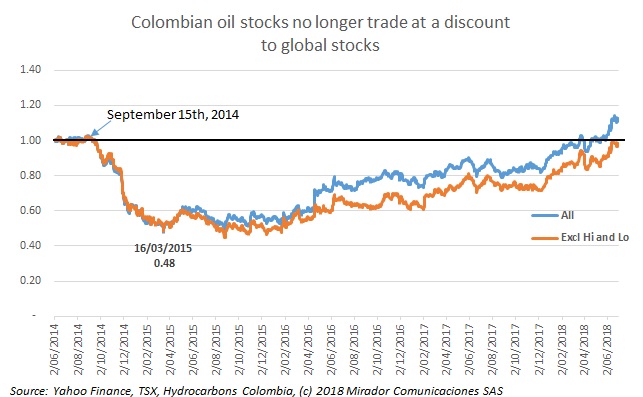

When Ronald Pantin was CEO of Pacific Rubiales he would complain that investors applied a ‘Colombia discount’ to Colombia-committed stocks. For a long time that appeared to be true, but it has been getting smaller and, this quarter, it disappeared. However, there are some important caveats.

The ANH’s Permanent Competitive Procedure is the most significant change in procedure in years. It opens the opportunity for continuous block assignments. Ten days ago, the ANH announced an important modification, finally allowing what Agreement 2 was supposed to have from the beginning: the ability to nominate blocks for assignment (which we have called browse-the-rack-and-pick-up-something-you-like). Leopoldo Olavarria and his team at Norton RoseFulbright have kindly prepared the following summary of the changes.

This graffiti adorns a 20-meter wall on Bogotá’s busy Septima (Carrera 7 / 7Th Avenue) in the heart of the capital’s elite neighborhood. It is virtually impossible that politicians, media types and other opinion leaders have not seen it or will not see it over the coming weeks. The inauguration of President Iván Duque has certainly reignited the debate over unconventional technologies.

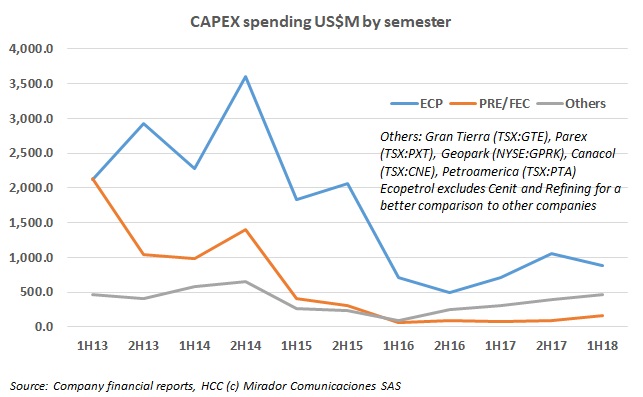

There was considerable debate among industry watchers about whether companies spent the Capex they expected to in the first half of 2018 or held the money back. As usual every case is different – and we had to make some assumptions — but it looks like they spent as expected or more, except ECP.

There is no hotter political topic in the industry at this time than unconventionals with both the Ministers of Environment and Mines and Energy making declarations recently indicating a more open approach than that of the previous government. As might be expected, this has ‘unleashed the hounds of war’ from the anti-fracking side. Here well-known geophysicist and frequent contributor Jaime Checa gives his view, rational and balanced as always, scarce attributes in today’s world.

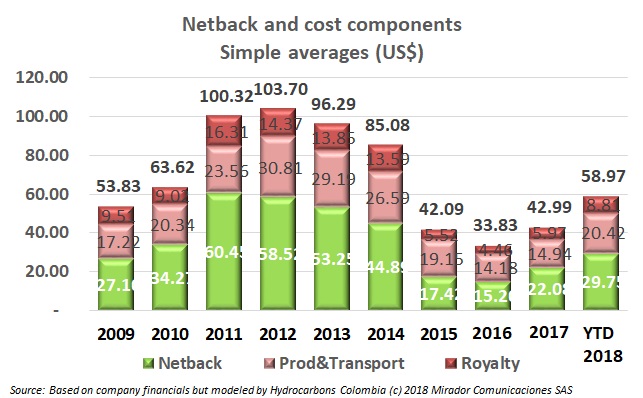

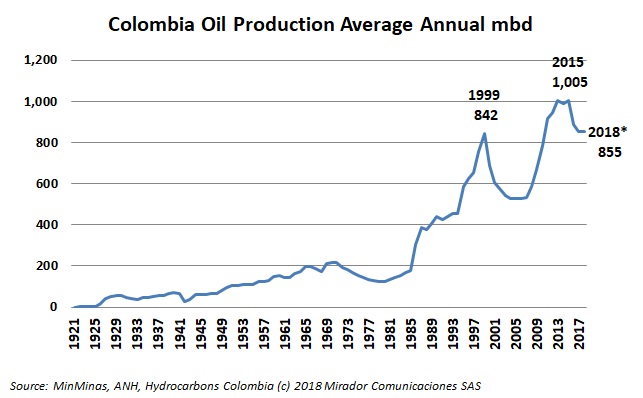

The bottom-line for a company are its profits and/or stock market performance. But we try to take a policy perspective so our bottom-line is production and reserves. Both were rather naturally affected by the oil-price crisis and so, maybe, “nobody’s fault”. The current industry question is how fast things have reacted to upward price signals and whether policy plays a role in that. Call it the U-curve.

I promised this three weeks ago now but, fortunately, we received a couple of important expert contributions on Ecuador and the new ‘permanent’ assignment process. Now that we are officially out of the Santos era and into the Duque era, it seems less important to do this. But a promise is a promise…