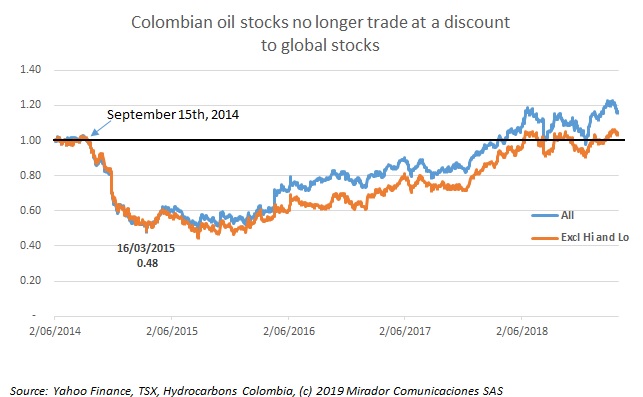

Just a short summary this quarter of our index of publicly-traded Colombia-focused E&P stocks because not much has changed.

One of the biggest changes by this new government has been finally launching the new Permanent Bidding Process. Originally announced in September 2015, it would be an understatement to say this has had a long gestation period. But it has finally arrived. We asked Marianna Boza and the team at Brigard Urrutia to give our readers an overview.

The publicly-traded Colombia-focused E&P companies have reported so we can publish our industry-wide netback estimates. Lower oil prices naturally had a negative impact on 4Q18 netbacks but, overall, 2018 was a good year.

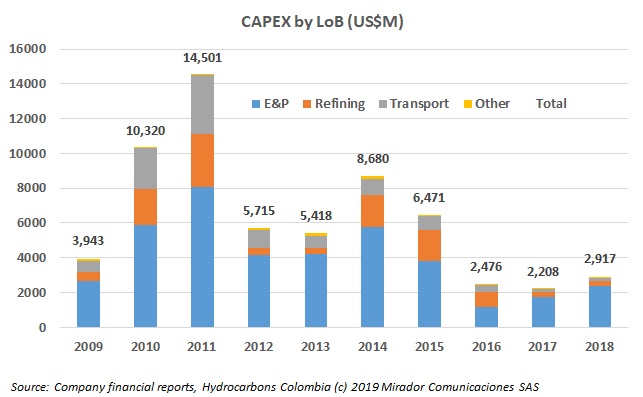

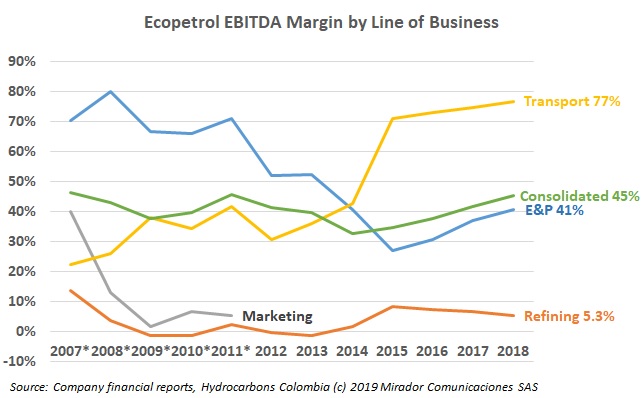

Once again, the Analyst thought of some charts he really would have wanted to publish in last week’s article about the NOC’s Line of Business (LoB) results but did not think of until a few days later. We know. We will speak to him about that. But he is right, the graphs are interesting so we will publish them this week.

Inspired by the rapid approach of baseball season, two short rather than one long comment this week, one on 2018 results so far and one on fracking, inspired by MinMinas naming five companies as being interested.

Ecopetrol published its results this past week and CEO Felipe Bayón was rightly trumpeting the NOC’s earnings for their contribution to the nation’s coffers. But hidden in the results presentation was worsening margins in the Refining Line-of-Business (LoB).

We are not at a milestone like ‘100 days’ or ‘six months’ but a lot has happened in the past month from a policy perspective so I thought I should write about it.

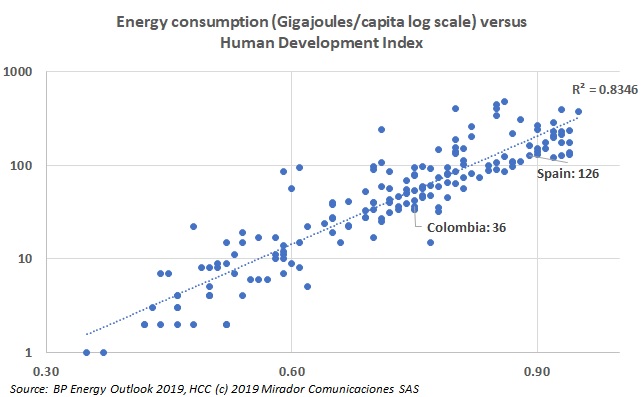

February 14th is Valentine’s Day in many parts of the world (and increasingly celebrated in Colombia). It is also the day that BP chose to launch this year’s Energy Outlook, an eagerly-awaited, multi-scenario look at the future of energy demand and supply. (OK, eagerly awaited by nerds like our Analyst.)

Last week, I was at my annual pilgrimage to a high-tech fair in Barcelona and it happens to occur directly after BP publishes its annual Energy Outlook. With the forecast in my head, this year I was particularly looking at the fair for trends that affect the oil and gas business. I found one that will have a definite impact and one that should, theoretically, but for which it was hard to find real-world examples.

On February 14, 2019 the Commission of Experts gave its report on the adoption of fracking / unconventional technologies for Colombian exploration and production. We have written several articles on the content. Here we talk about the press reaction.