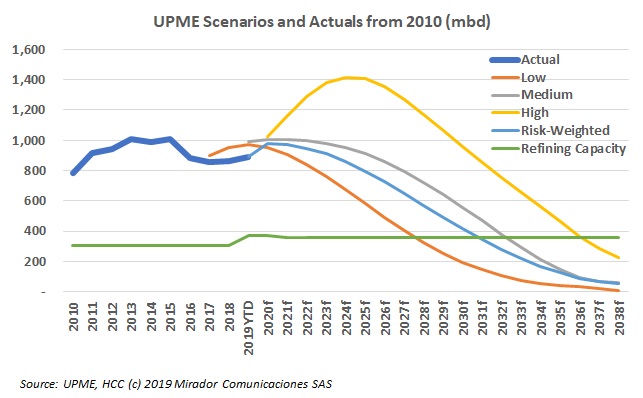

We might not always agree with the government’s Mining and Energy Planning Unit (UPME) but it is the authoritative source of long-term production forecasts. Recently it updated its production scenarios through 2038.

Women in Mining Colombia, IFC and the Canadian Embassy, with the support of the MinMinas, the ANM, the Australian Embassy and a number of members of the Colombian extractive industries, have launched the Gender ToolKit – A Toolkit of Actions and Strategies for Oil, Gas, and Mining Companies – an initiative to promote diversity and inclusion in sectors traditionally dominated by men.

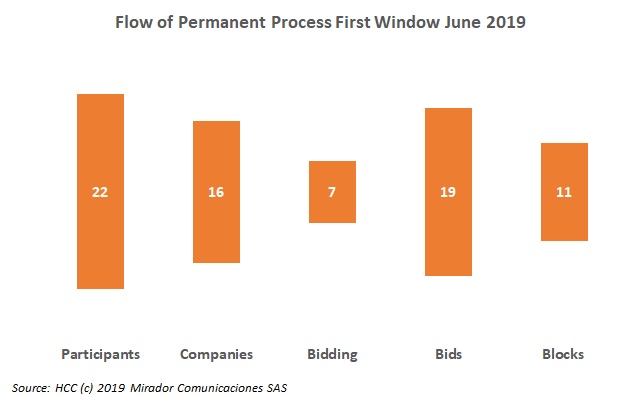

As we reported, recently the first ‘window’ of the new ‘permanent’ block assignment process (known as PPAA for its initials in Spanish) passed its first hurdle successfully. In this article, we look at the results, based on the notes we took at the event. Official results, have been published confirming our estimation of the leading bidder for each block.

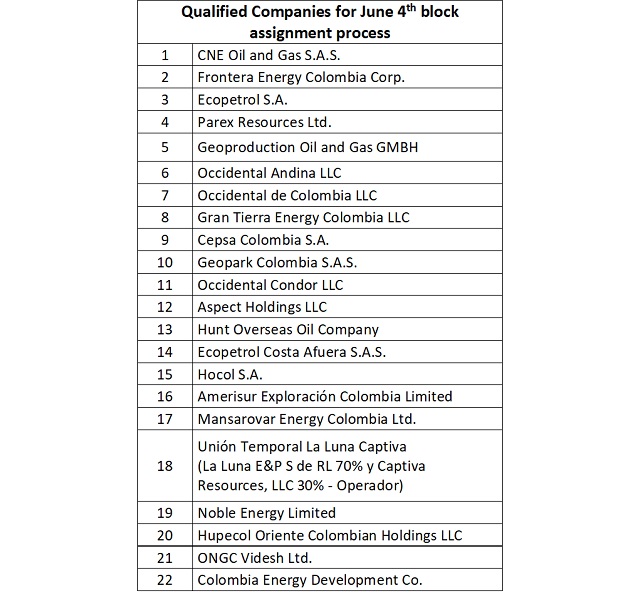

Tuesday, June 4, 2019 marks the first block assignment process since July 2014, nearly five years ago. Much has happened and oil prices – a primary determinant of investment and so participation – are still well below where they were during the last auction. Here is the announced list of qualified participants.

An anonymous reader reacted strongly to a recent article where the ANLA was talking about its operational improvements. Our reader’s point is that it is a waste of time and effort to look for operational improvements to a process that is fundamentally flawed to begin with. Here is the text of the email they wrote plus our Bottom-Line reaction.

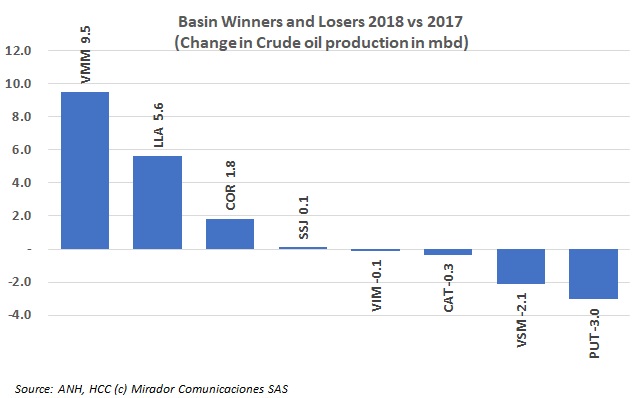

The ANH recently published field-level crude-oil production data for 4Q18, allowing us to update our database and look at where growth – or decline – took place. Overall production was up more than 11mbd in 2018 versus 2017 but this is usually due to a long list of growing fields (winners) offset but an equally long or longer list of declining fields (losers).

Acipet, the petroleum engineers’ association has been an important voice in defense of the industry’s interests. Here, the organization’s Chairman of the Board, Carlos Alberto Leal Niño, argues that the important work of transitioning away from fossil fuels in the future should be financed by developing the country’s hydrocarbons today.

Last week was a controversial one in Colombia’s congress with the ongoing battle over peace process implementation, approval of royalty reform in its opening debate and the final authorization of the government’s long-term economic plan (known as the PND for its initials in Spanish). The press reacted strongly to a clause about fracking but the politics of how one newspaper reacted was surprising, to me at least.

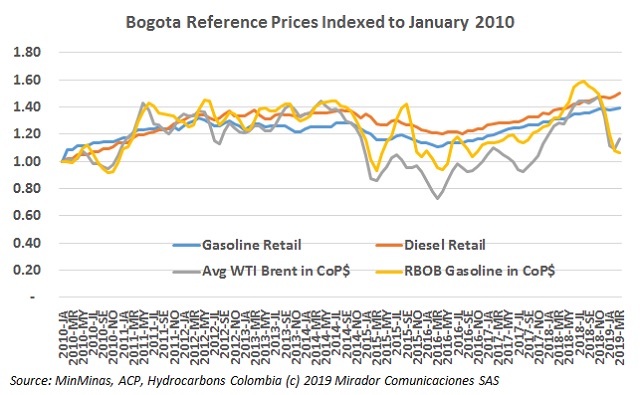

It has been some time since we looked at Colombia’s downstream sector so this week we update some of our charts.

As we reported recently, what we have been calling the “Commission of Experts” published their final report. It is 173 pages (in Spanish obviously) and not exactly stimulating reading (which shows its scientific ‘cred’). We abridged the two recommendations chapters, 13 and 14, and translated them into English. We hope you find it useful.