This past week, on August 7th, President Iván Duque completed one full year in office. A number of editorial writers evaluated the president at the completion of this milestone. We have been positive about the ANH and MinMinas (now known as MinEnergia) but the government in total has struggled with its grades.

In his most recent Op-ed, the President of the Colombian Association of Petroleum Engineers (Acipet), Carlos Leal, questioned environmentalists ‘fight’ in Colombia.

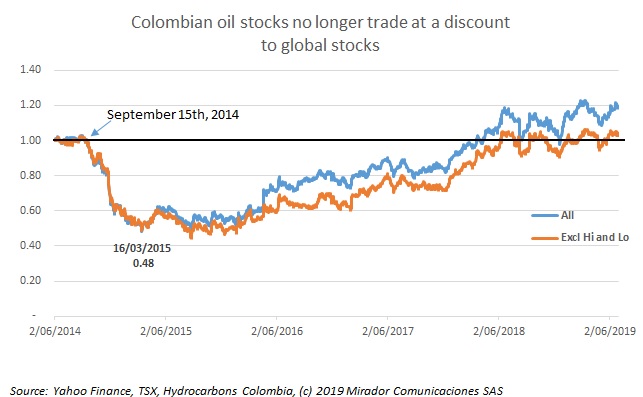

We are now firmly in the third quarter and so it is time to look back at how the shares of Colombia-focused producers performed in the second quarter. The short answer is that they continued to track global indexes, indicating that big-picture forces are more important (at the aggregate level) than Colombia-specific forces.

Carlos Leal, Head of the Colombian Association of Petroleum Engineers (Acipet), spoke about the industry’s situation and the role of Petroleum Engineers to guarantee the sector’s sustainability.

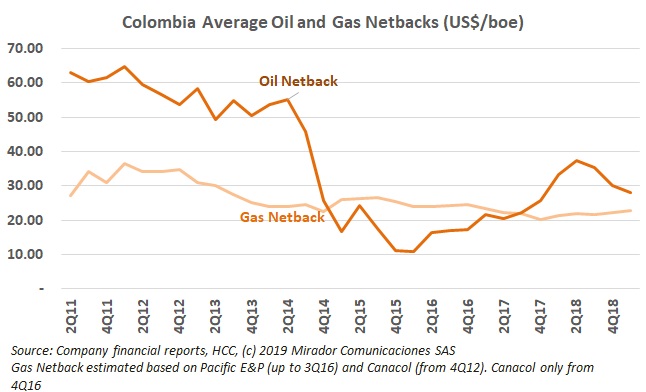

Average oil netbacks had a recent peak in 2Q18 and since then have been falling back. Oil is now within US$6 of gas on an equivalent barrel basis. Not enough perhaps to make a company change strategy but maybe to change some resource allocation decisions.

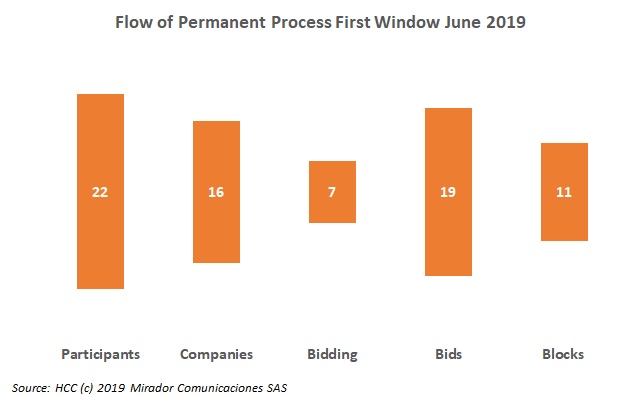

Only tomorrow will we know if Geopark responds to Frontera’s counteroffer for VIM 22 and the ANH’s first round of its Permanent Competitive Process (PPAA) will complete officially only on the 15th of July. But I think the ANH should already be breaking out the vintage soda water, declaring this round a success.

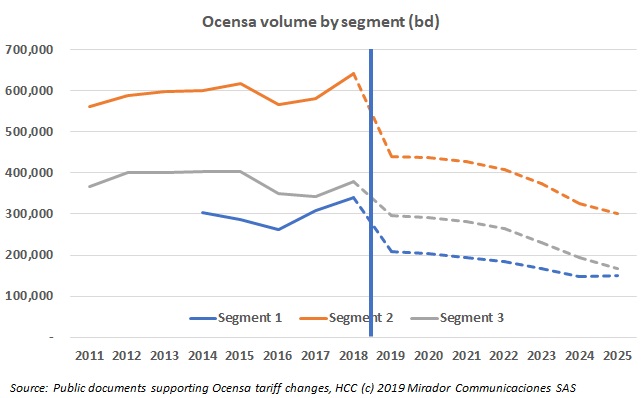

When you talk to those in the industry, they are generally upbeat about how things are going in both the short and medium term. Unless you are Ocensa. Then things are going badly. Very badly. Horribly in fact. At least, that is what it tells the regulator.

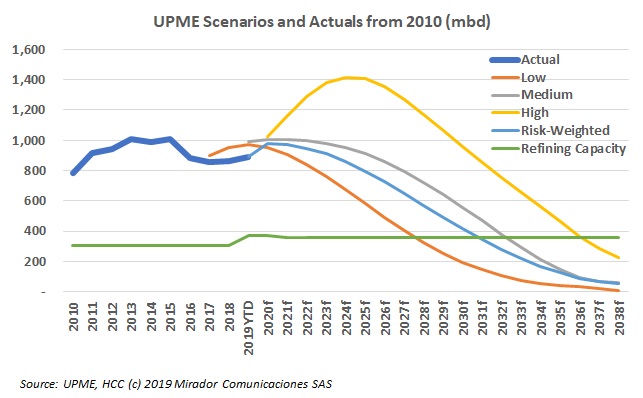

We might not always agree with the government’s Mining and Energy Planning Unit (UPME) but it is the authoritative source of long-term production forecasts. Recently it updated its production scenarios through 2038.

Women in Mining Colombia, IFC and the Canadian Embassy, with the support of the MinMinas, the ANM, the Australian Embassy and a number of members of the Colombian extractive industries, have launched the Gender ToolKit – A Toolkit of Actions and Strategies for Oil, Gas, and Mining Companies – an initiative to promote diversity and inclusion in sectors traditionally dominated by men.

As we reported, recently the first ‘window’ of the new ‘permanent’ block assignment process (known as PPAA for its initials in Spanish) passed its first hurdle successfully. In this article, we look at the results, based on the notes we took at the event. Official results, have been published confirming our estimation of the leading bidder for each block.