At the recent Parex 3Q20 results call, CEO Dave Taylor officially announced that Lee DiStefano, Colombia President and Country Manager for the past 10 years, was retiring after 40 years in the industry. I wanted to get his views on the Colombian situation, so I asked for an ‘exit interview’ – virtually of course.

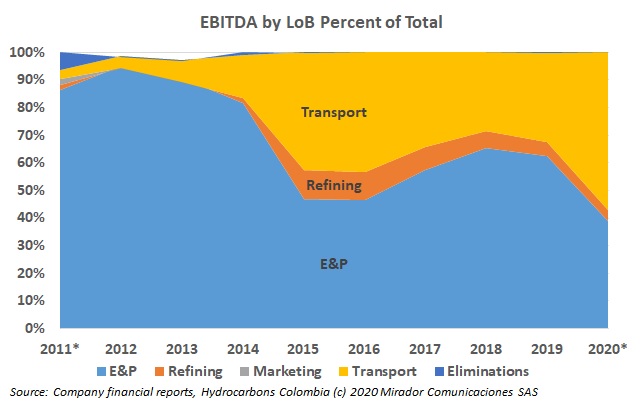

Lower oil prices and lower demand for fuel over the first nine months of 2020 accelerated the shift of Ecopetrol’s profits from producing products to transporting them.

Some may think I should publish my comments about Mexico in Hydrocarbons Mexico but HCM readers already know this sad tale and these remarks are going to be related to Colombia as well.

Last week’s top story from a readership perspective was the list of companies that qualified for the government’s upcoming auction (PPAA). No doubt readers were looking for any surprises: new players or non-participants.

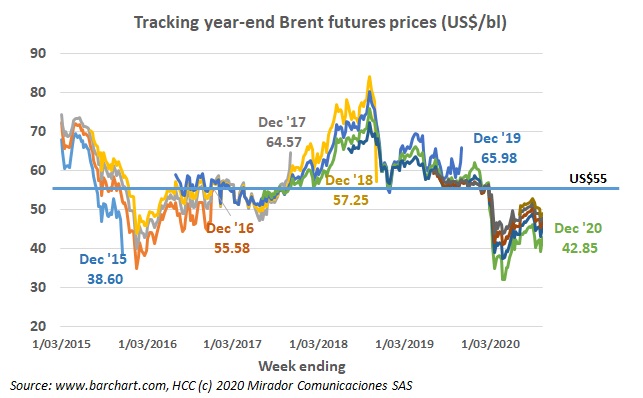

Last week’s article on long-term oil prices did not get a lot of readership. Maybe it was too heavy on the data analysis and too light on policy recommendations. This article focuses on policy.

Spot prices were up last week but President Trump’s physician has more influence over that than demand or supply fundamentals. Our long-term indicators are not going in the right direction.

Last week, leaders from the oil and gas industry came together (virtually) to launch Mujeres Oil and Gas, an initiative to bring greater gender equity to the sector. We attended and brought back this report.

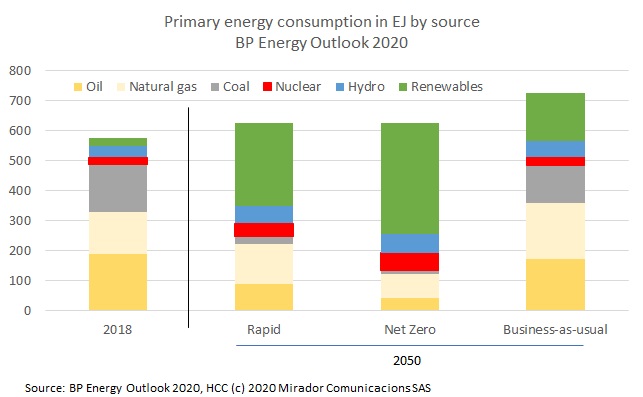

We normally do not write about global issues – we assume that you have your own sources for this information. But BP recently published its Energy Outlook after a long, Covid-19-induced delay, and, if an accurate reflection of the future, there are profound implications for the industry and for Colombia.

Carlos Leal, President of the Colombian Association of Petroleum Engineers (Acipet), spoke about the most recent propaganda by industry detractors: the ‘Fracking Challenge.’

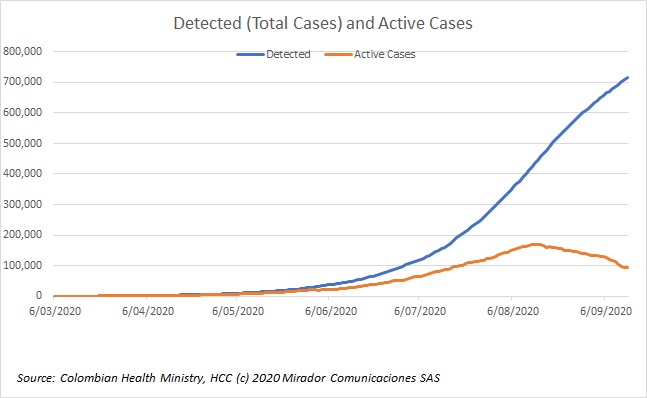

It has been nearly three months since our last article tracking key pandemic statistics so we thought these graphs might be useful. Things have been getting better but questions remain.