I have been reluctant to write this because so much seems up in the air but at the same time, the most important political issue affecting Colombian business today is the government’s proposed tax reform.

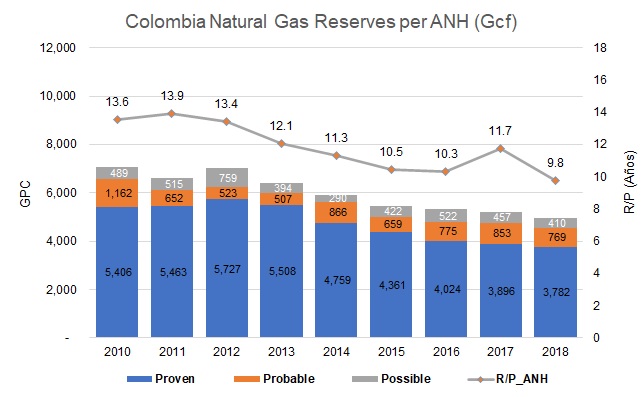

Because the MinEnergia research institute (UPME) thinks we need more gas imports. We thought our readers might appreciate seeing some of the UPME’s graphs that, in their professional opinion, mean that another re-gasification plant is necessary. The source for all these graphs is the UPME. All we have done is translate the labels and titles – and provide commentary.

Colombia’s export and investment promotion agency, ProColombia, launched a new campaign last week, “Colombia, The Most Welcoming Place in the World”. Also last week, Glencore was told by the National Mining Agency (ANM) that it could not leave.

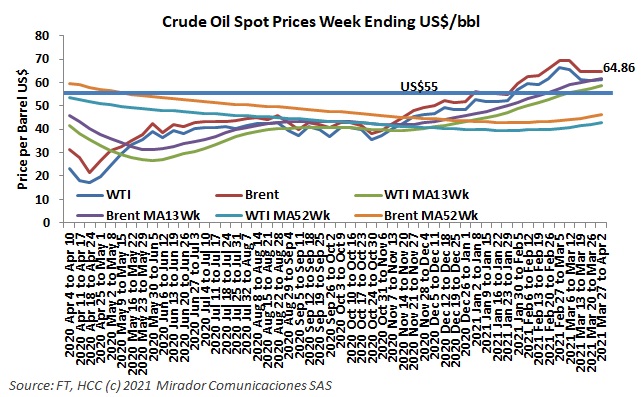

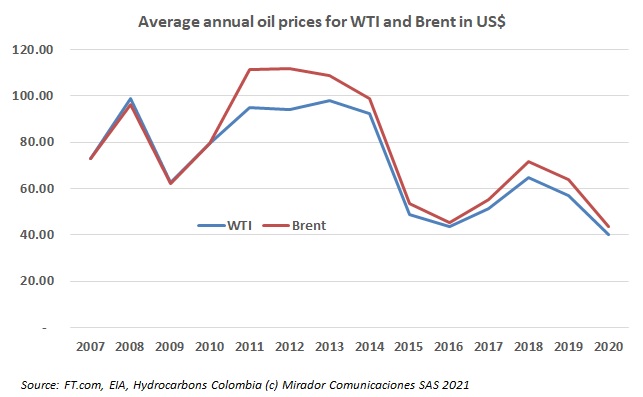

Crude oil prices have taken a bit of a tumble recently so we thought we should update our standard charts as well as show a new one we have been working on.

This was a decidedly minor news item. It only merited a tweet, not even an article in Hydrocarbons Colombia. But as I investigated, and thought about it, it opened up a number of relevant ideas about E&P, the environment and communities.

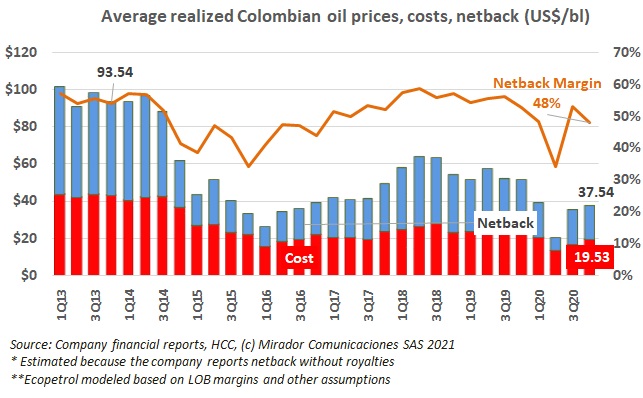

Time for us to review prices and netbacks for our Colombia focused publicly traded companies. Prices were up in the quarter but so were costs so not a good quarter on average. As always, individual results may vary.

I think MinEnergia and the Colombian government more broadly are mixing up two important, and related strategies to the detriment of the E&P industry. I have written about this before but it is worth repeating.

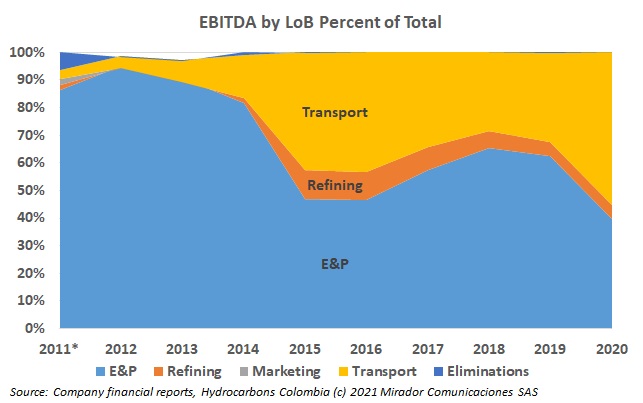

Or why Hacienda likes the idea of ECP diversifying away from oil and gas: It does not seem to do them very well.

Since coming back from the year-end holidays, the Colombian business news – and our modest newsletter – has been dominated by Ecopetrol’s surprise announcement that it was bidding for the country’s long haul electricity transmission provider ISA. This has put the NOC’s long-term strategy up for public debate. Coincidentally, two global thinktanks published separate but similar studies warning National Oil Companies to change their investment plans. A song for Felipe Bayón.

A reader question arose about forecasting oil prices for business cases so we thought it worthwhile to go through some of the alternative methodologies and say what we would do.