We normally publish our statistical review of the previous year around mid-first-quarter. But some key figures were delayed so we decided to wait until the end of the quarter. Hoping you find these charts useful for presentations or strategic discussions. Subscribers can request the Excel versions to do their own graphic design.

Ricardo Roa Barragan was appointed President of Ecopetrol this week by a board named only two weeks before. Who is he? Who is on the new board? What can we expect?

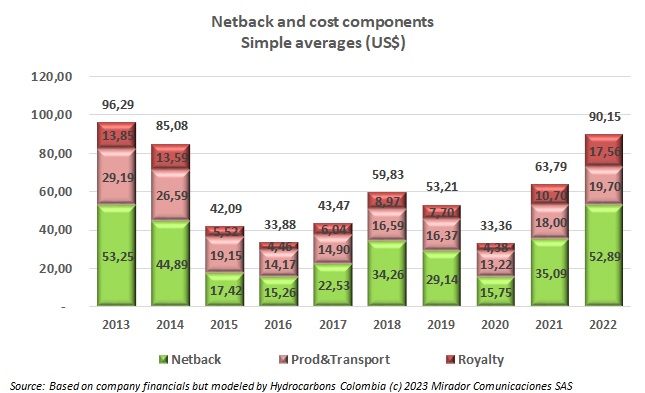

At least for the last few years, oil prices have determined average Colombian netback, since margins have been stable. Prices fell in 4Q22 and so netback did too.

Through the end of the day on March 28th, President Gustavo Petro’s “Total Peace” process was having an up and down month but on balance, not as bad as February. That evening the ELN attacked an army post in Catatumbo and the wheels came off his major project.

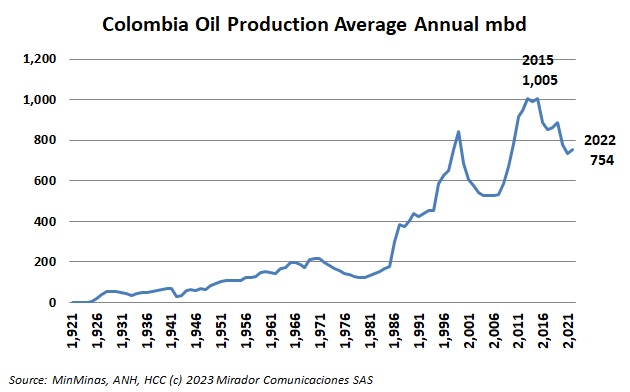

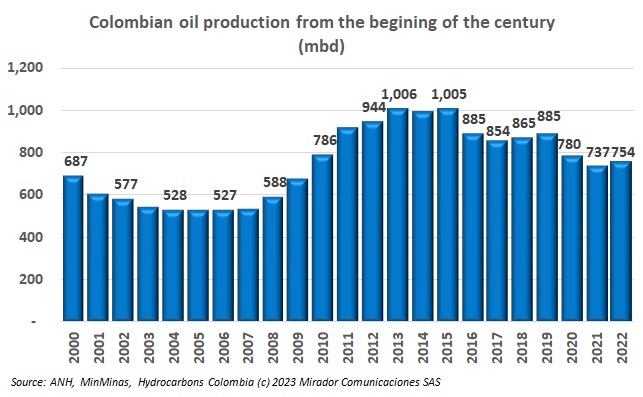

Crude oil production rose in 2022 after a poor 2020 and 2021 as the lead graph shows. With hundreds of fields, some increased production and others decreased. We updated our field-level database and dug into the details to see the “Winners and Losers”.

This week, a two-part “What We Think”. Firstly, Campetrol’s Nelson Castañeda spoke to the national press, naturally about rigs, saying the February 2023 count fell again because of social conflict. Not coincidentally, we published an article based on a press release by Colombia’s Ombudsman saying incidents year-to-date February 2023 increased 73% over last year. And for those with the patience to stick to the end, a reflection on Ecopetrol as we await Felipe Bayón’s replacement.

Last week the headlines were all about Ecopetrol’s record breaking earnings, and that they were. Virtually every Line of Business (LoB) also hit new highs. ISA’s contribution was “showy” at least for EBITDA but its contribution to earnings was much more modest.

I concluded last month’s article by describing “some hope in an otherwise dismal month.” Yes, the ELN and the government did restart their meetings in Mexico but I don’t think I could come up with even a glimmer of hope for an even more dismal month.

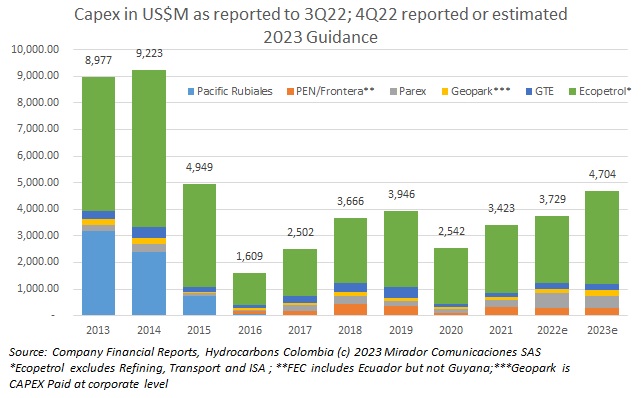

The publicly-traded, Colombia-focused E&Ps have all published their CAPEX guidance and expectations for Brent for the coming year. Normally, we see that price is the biggest determinant of CAPEX but this year might be different with a left-leaning, activist government. Can we see any evidence that policy changes and / or the new tax laws have had an influence?

Almost exactly five years ago, I wrote a “What We Think” entitled “Still I look to find a reason to believe” about searching for optimistic signs in a complex situation as Colombia went into an election year (2018). This morning the Tim Harden song that inspired the title came up at random on Spotify and, listening to the words, I thought about ‘recycling’ the lyrics as a structure for current events.