Early in the month, the Colombian government and the ELN signed a ceasefire protocol which supposedly will let them negotiate substantial issues without the pressure of violence. We’ll see how that goes.

… but it is really no one’s fault. OK. Maybe we can blame the Saudis since they say they can control oil prices. But maybe we can’t.

I have been sitting on this story since late May, not knowing whether to use it or where to use it. Technically, it is an energy-related story and so I should put it in ePowerColombia (ePC). But we deal with social conflict issues more in Hydrocarbons Colombia so it seems right to address the issue here.

We wrote about the 2022 Colombian reserves report a few weeks ago but that was more a reaction to the press release (focused on the Minister) and not a deep dive into the results. What is the real story?

Congress and the opposition once again called for Danilo Rueda’s head as violence flared and the dissident FARC process came apart even before the first formal meeting. The ELN process passed through some rocky moments when it looked like the government would suspend those dialogues as well, but the parties still talk in Havana.

The MinEnergia press release on 2022 year-end reserves was a triumph of belief over science, a testimony of the power of politicians to warp their interpretation of reality to conform to what they have already decided to do.

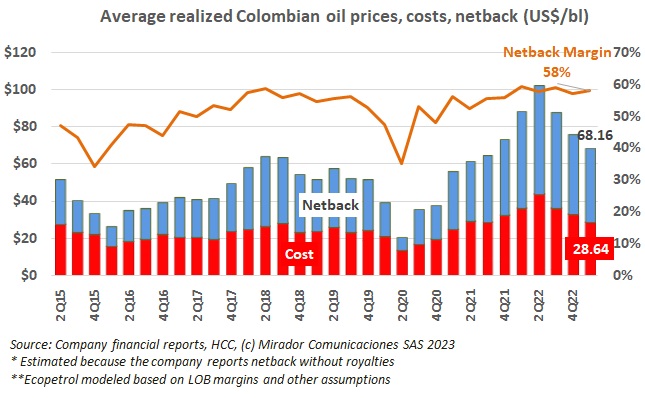

Ricardo Roa did not affect Ecopetrol’s 1Q23 results and will have little influence over 2Q23 having taken command only at the end of April. But Felipe BayóN was already leaving in 1Q23 so others like Chairman Saul Kattan might have had more impact. Some key issues for the NOC’s next phase appear in the numbers already.

José Antonio Ocampo has barely left the building. His replacement Ricardo Bonilla has barely learned the passwords on his new computer and already he had to correct MinEnergia Irene Vélez on fundamental economics. This time it concerns gasoline pricing.

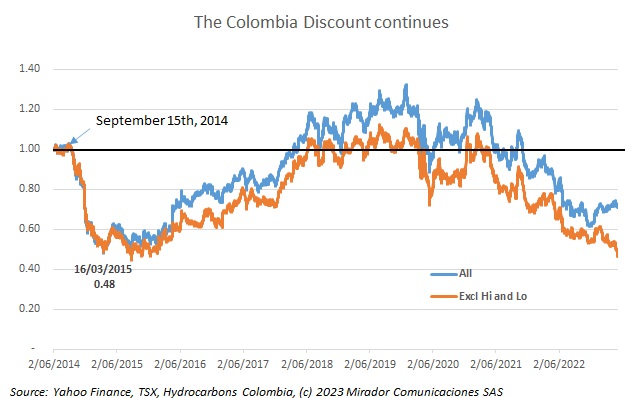

Ricardo Roa had his first press conference as Ecopetrol president and investors punished the stock. His ultimate boss, Colombian President Gustavo Petro, would have been happy with Roa’s strict adherence to the government’s official energy policy but commentators questioned the strategy and the share price plummeted.

National newspaper El Espectador used the phrase for an article on the upcoming third round with the ELN. It seemed like a good summary of April as things slipped through the government’s fingers.