Colombia at the Regional Energy Meeting organized by theEnergy Resources Office of United States.

GasThe president of the Colombian Natural Gas Association (Naturgas), Orlando Cabrales, spoke about the low carbon emissions of VNG and its advantages for the environment.

GasThe Superintendence of Public Services (SuperServicios) published a report on the performance of the natural gas costs service around Colombia. Some regions were excluded, as these have no access to the national system.

GasVenezuela was supposed to start selling gas to Colombia five years ago, and today there is no certainty on when will the deal begin.

GasThe construction of regasification plants in the country has generated much debate. The controversy over the possibility of a new plant in the Pacific remains latent.

GasDuring the presentation of Promigas’18threport on natural gas, Deputy Minister of Energy (MinMinas) Rutty Paola Ortiz said that the regulation to develop shale gas is ready, and it considers all aspects so that this technique can be applied safely.

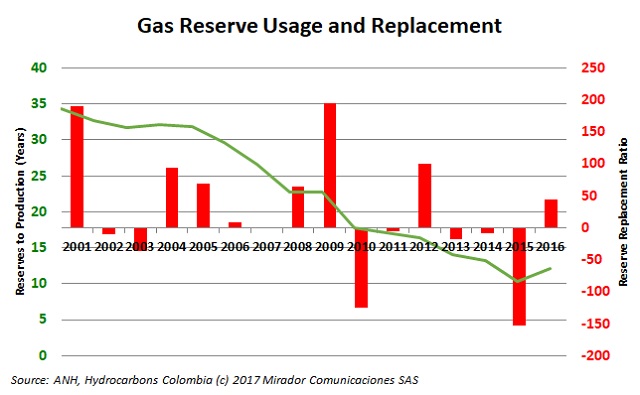

GasOne of the government’s major concerns is to guarantee energy self-sufficiency, and gas and oil reserves have been a subject of much debate in Colombia. Antonio Celia, President of Promigas, spoke about gas reserves and his perspectives.

GasThe Ministry of Mines and Energy (MinMinas) published a statement about the Special Fund for Natural Gas Development (FECFGN) and deadlines for requesting infrastructure funds.

GasNaturgas president Orlando Cabrales spoke about the country’s gas reserves, and legislator Antonio Correa warned about the negative effects of importing gas.

GasThe Company took the Colombian government to the court earlier this year, after a dispute over its Electricaribe subsidiary. Now it is questioning its presence in the country.