The Minister of Mines and Energy (MinEnergia), María Fernanda Suárez, and Naturgas’ Orlando Cabrales, spoke about the increase in natural gas connections during the last year.

The Ministry of Mines and Energy (MinEnergia) spoke about the recovery of the oil, gas and energy industries, amid the health emergency.

The Colombian Propane Association (Gasnova) spoke about the behavior of propane demand in Colombia, amid the crisis.

The Energy and Gas Regulatory Commission (CREG) announced modifications to fuel gas tariffs, following Resolution 048 of 2020.

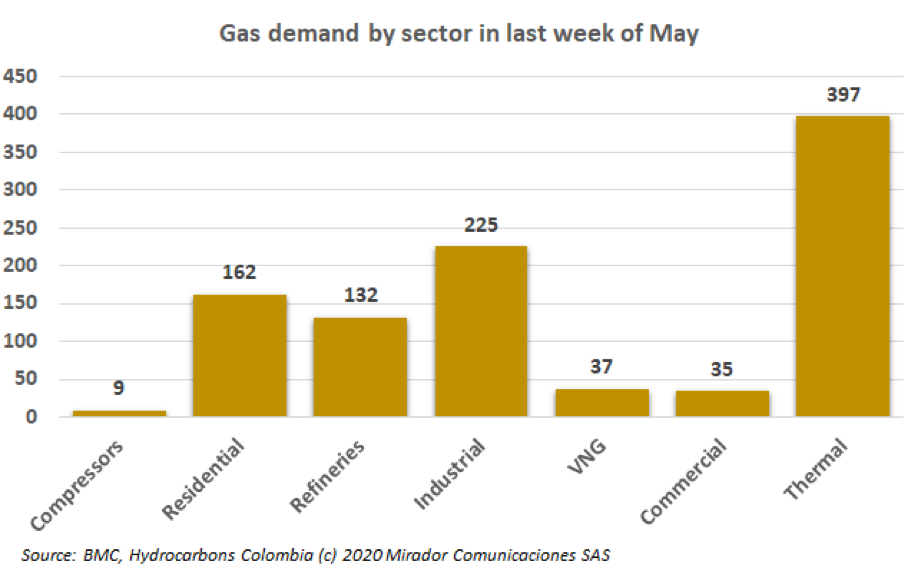

The Colombian Mercantile Exchange (BMC), operator of the natural gas market, published its report for the behavior of the gas sector during May this year.

Complaints about the high costs in gas tariffs led the government to create a new transitory scheme to reduce this service’s prices.

Colombia’s Natural Gas Association (Naturgas) spoke about the challenges and opportunities of the natural gas market in Colombia.

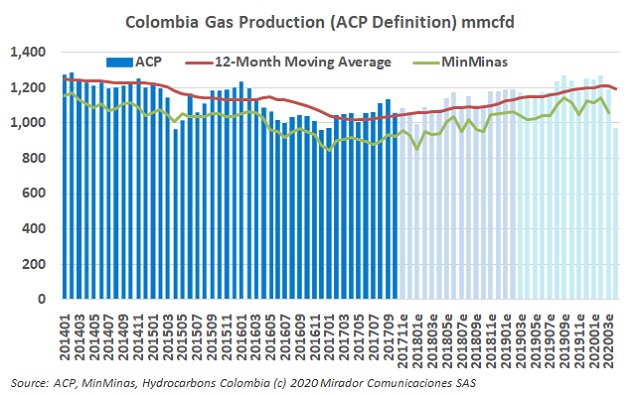

The Ministry of Mines and Energy (MinEnergia) reported natural gas production figures for April 2020.

The Colombian Mercantile Exchange (BMC), operator of the natural gas market, announced the results for natural gas consumption during May 2020.

Portafolio hosted a virtual forum where industry experts spoke about the national gas market.