During the 2025 Naturgas Congress, Ecopetrol (NYSE: EC) President Ricardo Roa Barragán announced the detailed roadmap for the company’s Pacific Coast regasification project, which will allow Colombia to import natural gas through a new terminal located in Buga, Valle del Cauca.

At the 2025 Naturgas Congress, Luz Stella Murgas, President of Naturgas, delivered a strong critique of the Colombian government’s approach to energy transition under President Gustavo Petro.

Ecopetrol (NYSE: EC) and Petrobras (NYSE: PBR) have successfully completed formation tests at the Sirius-2 well, marking a major step in the evaluation of what is now considered Colombia’s largest offshore natural gas discovery.

Luz Stella Murgas, president of the Colombian Natural Gas Association (Naturgas), presented a comprehensive proposal to President Gustavo Petro’s administration.

Juan Manuel Rojas, President of Promigas, has been re-elected to continue as Chairman of the Board of Directors of the Colombian Natural Gas Association (Naturgas) for a second consecutive year.

While the urgency of securing long-term gas supply is undeniable, some recent proposals, like the idea of importing gas from Qatar, may have more negative consequences than benefits.

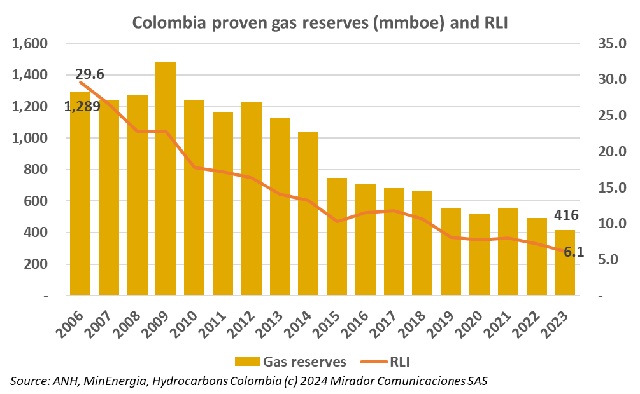

It rained heavily in much of the country in 1Q25, filling up the reservoirs and lowering the demand for natural gas for thermoelectric generation. But non-thermal demand grew while domestic supply was flat meaning Colombia crept ever close to importing gas for domestic demand on regular basis.

During the forum “Energy Security and Sovereignty: Building a Sustainable Future”, experts from Colombia’s energy sector raised urgent concerns about the country’s gas shortages, regulatory hurdles, and rising energy tariffs.

The natural gas sector in Colombia is facing a critical juncture. Luz Stella Murgas, President of the Colombian Natural Gas Association (Naturgas) talked about this situation,

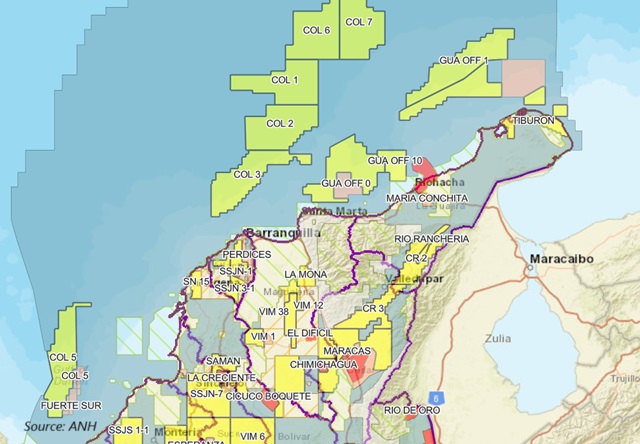

The president of the National Hydrocarbons Agency (ANH), Orlando Velandia, talked about the process to award environmental licenses for Block GUA-OFF-0, formerly known as the Tayrona block.