Ecopetrol’s (NYSE: EC) Ricardo Roa Barragán talked about key issues such as exploration and gas imports, among other.

Ecopetrol (NYSE: EC) and Oxy (NYSE: OXY) achieved record oil production in the US through fracking.

Ecopetrol (NYSE: EC) received notification that the International Chamber of Commerce in New York ruled in its favor in the arbitration dispute between Reficar and CB&I regarding the contract for the expansion and modernization of the refinery in Cartagena.

Ecopetrol (NYSE: EC) will allow more than 475,000 Colombians from all regions to benefit from 27 projects planned under the Tax-for-Infrastructure program.

Ecopetrol’s Ricardo Roa, made surprising statements about the company’s operations.

Ecopetrol’s (NYSE: EC) Ricardo Roa Barragán discussed the role of natural gas in the company’s growth and energy transition strategies, in line with the policies of the government under Gustavo Petro.

Ecopetrol’s (NYSE: EC) Ricardo Roa has unveiled his latest estimate of transfers to the nation over the next three years.

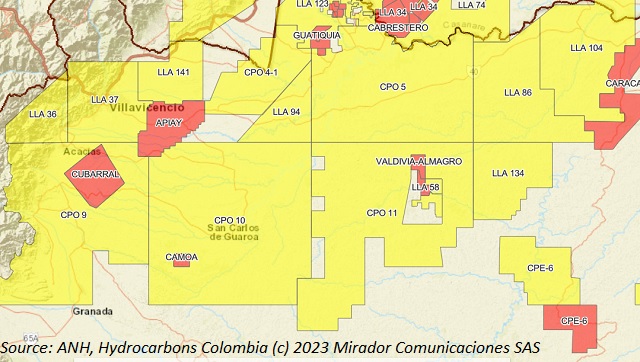

Ecopetrol (NYSE: EC) and Repsol (MSE: REP) have announced a significant oil discovery at the Tinamú-1 exploratory well, located in the municipality of Castilla La Nueva, Meta.

Katherine Miranda, a representative in the Chamber for the Green Party, raised concerns about the urgent need for the Gustavo Petro government to make a payment on the of the Fuel Price Stabilization Fund (FEPC) deficit.

Ecopetrol (NYSE: EC) has reached a new collective bargaining agreement with the USO and six other unions.