Ecopetrol (NYSE: EC) announced a significant offshore natural gas discovery in the southern Caribbean region of Colombia.

Ecopetrol’s (NYSE: EC), Ricardo Roa, provided his testimony via video conference to the Inspector General’s Office as part of the disciplinary proceedings against Nicolás Petro Burgos, the eldest son of President Gustavo Petro, on charges of alleged illicit enrichment.

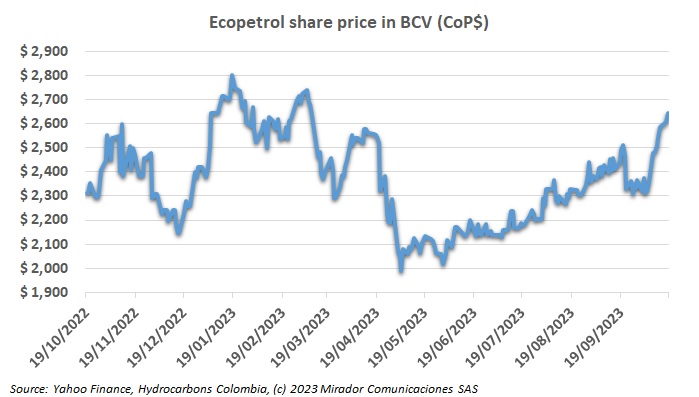

Ecopetrol (NYSE: EC) is experiencing a surge in its stock performance on the Colombian Stock Exchange (BVC) this October.

Ecopetrol (NYSE: EC) reported the statistics of those hired from January to August 2023.

In a strategic move to further consolidate its position in the North American market, Ecopetrol (NYSE: EC) announced the operational launch of its new trading subsidiary, Ecopetrol US Trading (Eust), based in Houston, Texas, USA.

Ecopetrol (NYSE: EC) recently announced that its president, Ricardo Roa, held discussions with Spanish companies and state entities to share the company’s vision for Colombia’s energy future.

Ecopetrol (NYSE: EC) announced the appointment of a new executive.

Moody’s Investors Service affirmed Ecopetrol’s baseline credit assessment (BCA) at ba3 and its issuer rating at Baa3, along with the senior unsecured ratings.

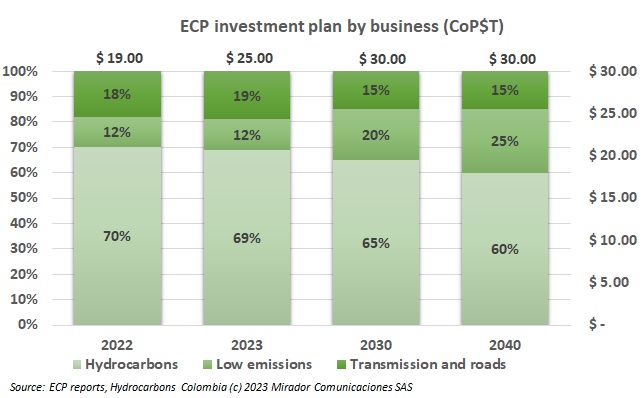

Ecopetrol (NYSE: EC) announced a new strategy for the next 20 years.

In the early hours of Saturday, September 2nd, a powerful storm accompanied by strong winds wreaked havoc on Ecopetrol’s (NYSE: EC) refinery located in the municipality of Barrancabermeja, Santander Department.