In recent months, Colombia’s state-owned oil giant, Ecopetrol (NYSE: EC), has been at the center of a growing controversy, following decisions that analysts fear could lead to its demise.

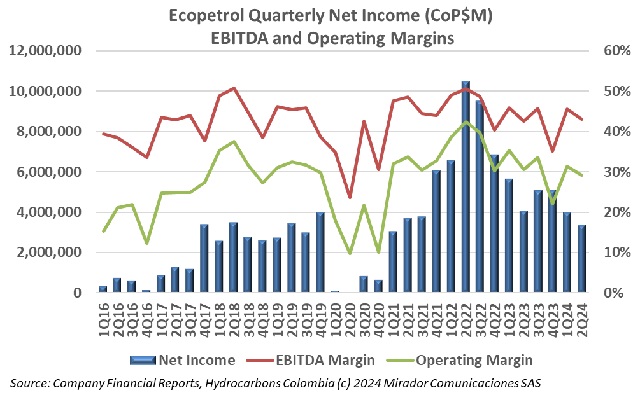

Ecopetrol (NYSE: EC) announced its second quarter 2024 results, with a continued decrease in key metrics.

Ecopetrol (NYSE: EC) is facing increasing scrutiny following a controversial decision by its Board of Directors to pass on a significant investment opportunity in the US.

Ecopetrol (NYSE: EC) announced that the Uchuva-2 well has confirmed the extension of a gas discovery made in 2022 with the drilling of the Uchuva-1 well.

Ecopetrol (NYSE: EC) decided not to pick up its option on CrownRock, a subsidiary of Occidental Petroleum Corp (NYSE: OXY).

Fitch Ratings affirmed the long-term and short-term national ratings of Ecopetrol S.A. (Ecopetrol) at ‘AAA (col)’ with a Stable Outlook and ‘F1+(col)’, respectively.

The oil industry is pushing the boundaries of offshore exploration with plans to drill a record-breaking well in Colombia’s deep waters within the next few months.

Ecopetrol (NYSE: EC) recently held its first-ever meeting with the USO Colombia union, a significant labor movement representing 25,000 workers in Colombia’s energy sector since 1923.

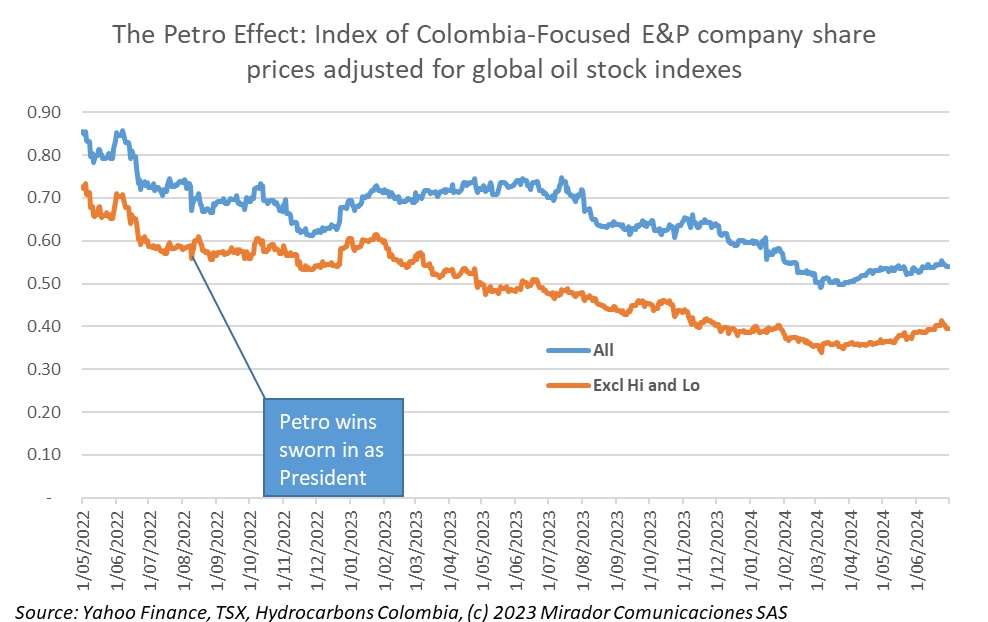

Our index of the share prices of Colombia-focused, publicly traded companies still lies well below where it was on May 1st, 2022 when the prospect of a Gustavo Petro presidency seemed distant. But there has been some improvement in the last quarter or so.

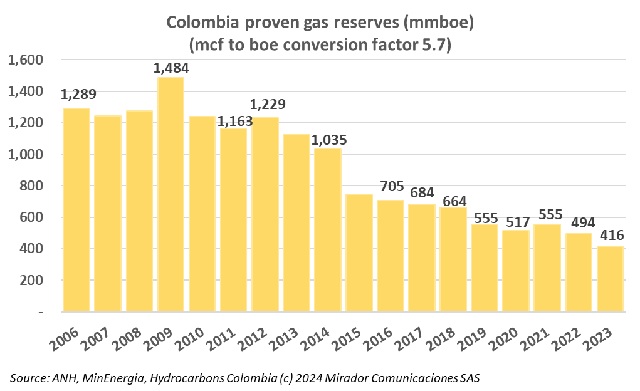

Ecopetrol (NYSE: EC) is making strides with its 2024-2034 roadmap, aimed at ensuring a reliable supply of natural gas to over 40 million Colombians.