Ecopetrol (NYSE:EC) says that it signed CoP$14T (US$7.44B) worth of contracts with suppliers from January to September of this year, of which 92% went to Colombian companies.

Workers demanding payment of salaries and debt from contractors at Ecopetrol (NYSE:EC)’s Porvenir pumping station in the Monterrey municipality have lifted their blockade after the NOC intervened to provide guarantees.

Ecopetrol (NYSE:EC) had made offers to buy two shipments of gasoline and two of nafta for dilution, which should arrive in November.

Promoting dialogue, attending to the community’s concerns and helping to resolve problems which affect residents is part of Ecopetrol’s (NYSE:EC) mission says its VP of HSE and sustainable operations, Óscar Villadiego. If only it was that easy.

Ecopetrol (NYSE:EC) says that it has started a two week study into the seafloor of the RC-9 offshore block in the Department of La Guajira, emphasizing that it is following the procedures required to start exploratory drilling.

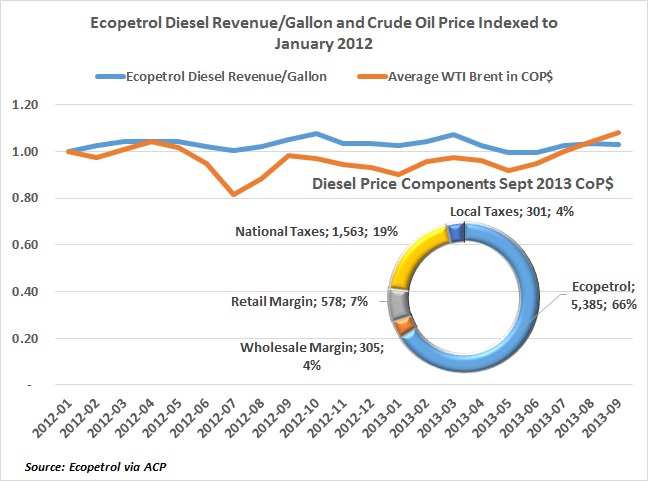

The ramifications of the Constitutional Court’s ruling that congress, not the executive branch, is responsible for the fixing of fuel prices or subsidies will render two big losers: Colombian consumers and the NOC Ecopetrol (NYSE:EC).

Reclame Colombia, an activist group advocating small scale mining over multinational, large-scale projects, held a debate in Bogotá on the future of the Rubiales field after the concession contract held by Pacific Rubiales (TSX:PRE) expires.

Selling a small percentage of Ecopetrol (NYSE:EC) instead of the whole of electrical energy generator Isagén would be preferable for the government to raise money for a needed investment in infrastructure says the VP of Colombia’s Senate, Carlos Emiro Barriga.

Canadian Pacific Rubiales Energy (NYSE:PRE) has proposed that it deploy Synchronized Thermal Additional Recovery (STAR) in the Rubiales field to boost its current production and hand off current primary production to Ecopetrol (NYSE:EC) once the current production contract expires in 2016.

UPDATED — Colombia’s Supreme Court has ruled the current pricing scheme in which the presidential administration smooths prices is unconstitutional. Instead any mechanism should fall to congress. Meanwhile the Liberal Party pushes the new mines and energy minister to study a decrease in fuel prices.