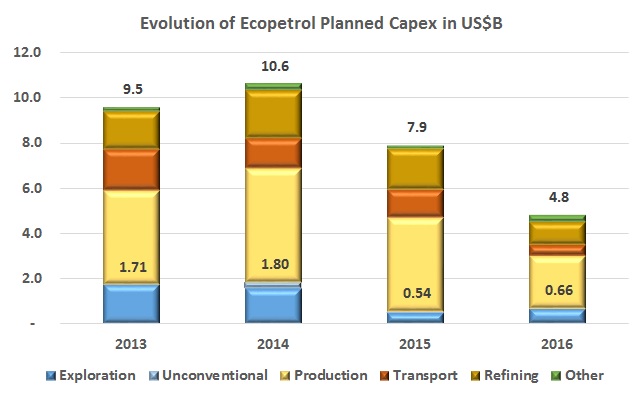

The Colombian Chamber of Oil Goods and Services (Campetrol) published an analysis of how Ecopetrol’s (NYSE:EC) exploration budget has shifted to market conditions over the last several years, and urged the NOC to step up exploratory efforts and spending.

The USO said that its presence has been critical to support community residents in Monterrey, Aguazul and Tauramena who are protesting Ecopetrol’s decision to eliminate transportation for contractor workers, which it says is another sign of the NOC using the oil price crisis as an excuse to weaken worker rights.

USO affiliated workers at the Barrancabermeja have put up the greatest resistance to Ecopetrol’s (NYSE:EC) cost cutting measures, with a continued run of protests and blockades affecting the area since mid-December. An unstructured dialogue continues for now.

Ecopetrol has unveiled a number of different road and small infrastructure projects, as well as a “bio-health park” and aqueduct. These and other Corporate Social Responsibility (CSR) related stories in our periodic summary.

“Cash is King” says Ecopetrol (NYSE:EC) president Juan Caros Echeverry about the outlook for 2016. Apart from keeping a firm control on its costs, the NOC is also looking to both sell participation in some offshore blocks and acquire shares of blocks in foreign waters.

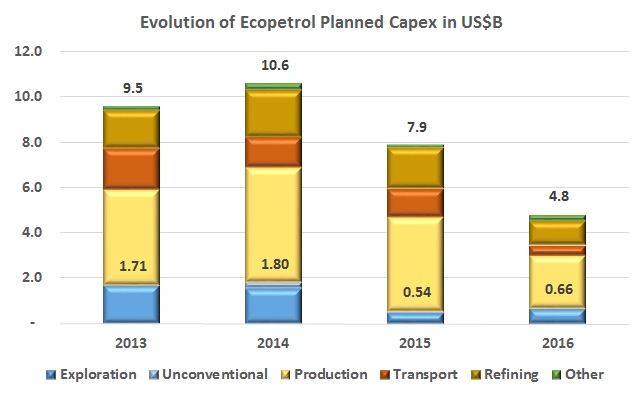

Ecopetrol (NYSE:EC) says that it will deepen its spending cuts and austerity program and reduce its investments in 2016 to US$4.8B, in a plan that looks to keep production at a similar level of 2015.

In his annual account rendering the General Controller (CGR) Edgardo Maya Villazón said that cost over-runs associated with the modernization of the Cartagena Refinery (Reficar) are one of his main concerns, and that the entity will soon release a report on its findings so far.

Ecopetrol (NYSE:EC) has announced more cost cutting measures, one of its main strategies to keep the company profitable. The cuts will affect not just contractors but its staff, and comes as ECP’s stock falls to historic lows.

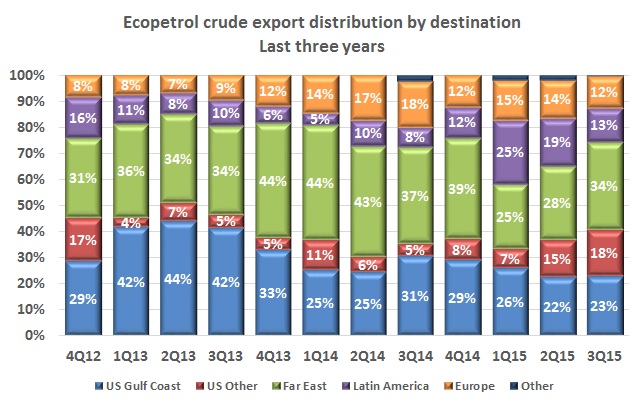

The battle over oil prices is a battle over production with Saudi Arabia saying it wants to regain US market share lost to higher-cost shale oil. But that is light oil and US refineries still need a significant supply of heavy crude due to the configuration of their plants. The graph shows that the US represents an increasing share of Ecopetrol (NYSE:EC) exports, at least over the last six quarters.

Ecopetrol (NYSE:EC) held a shareholders meeting in Medellín and said that it would strengthen its exploration activities abroad, setting an investment goal per year of US$1.25B on average, destined for the Gulf of Mexico, Peru, Brazil and Colombia’s offshore blocks.