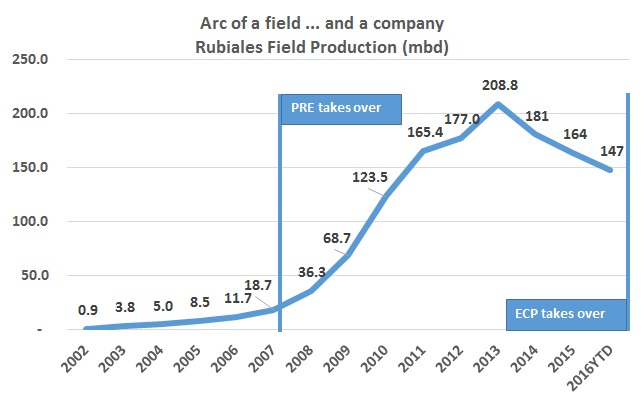

As we write this the Rubiales field is hours away from being reverted to Ecopetrol (NYSE:EC), marking the end of an era for Pacific E&P. Starting at 12am on Friday, July 1, the NOC will be tasked with taking the field over, and plans to start a new drilling effort to maintain its declining production level.

The other major reversion (besides Rubiales), Ecopetrol (NYSE:EC) is set to receive the Cusiana field on July 4th, after the end of the Tauramena association contract, signed originally between BP (NYSE:BP) and Ecopetrol in 1986.

Ecopetrol (NYSE:EC) has made good on promises to sell off its non-core assets, and has announced a ‘2016 Field Round’ in which it is auctioning 20 assets to the oil & gas industry.

A small sign of progress as Ecopetrol (NYSE:EC) confirmed that it has restarted a drilling campaign, with new developmental wells in the Chichimene and Castilla fields, after a renegotiation of its drilling contracts that culminated last month.

The World Bank performed a study of innovation at the global level and highlighted the importance of INNpulsa Colombia as a key institution for helping to develop Colombia´s productivity. Ecopetrol (NYSE:EC) is positioned as one of INNpulsa important partners.

Ecopetrol (NYSE:EC) now has full authorization to sell its petrochemical unit Propilco, despite questioning from critics as the operation can benefit from an expanded Cartagena Refinery (Reficar), one of the arguments used by the NOC to justify its acquisition in the first place in 2007.

Ecopetrol (NYSE:EC) has celebrated the 31st anniversary of the Colombian Petroleum Institute (ICP) its R&D center which it says has delivered proven benefits to the NOC worth US$4.17B.

Ecopetrol (NYSE:EC) is now set to receive the Rubiales field at the end of the month, and has also established its workforce which will staff and operate the field.

A question from a subscriber – what is Colombia’s internal demand for crude? – provoked a top-of-mind answer, which is often not the correct answer. We were close but the graph shows the big numbers and the trend.

Ecopetrol (NYSE:EC) is passing through a test due to fallen production and low prices, says the former Minister of Mines and Energy Amylkar Acosta, who believes that the NOC will be able to make it through, but without any idea of when this could conclude.