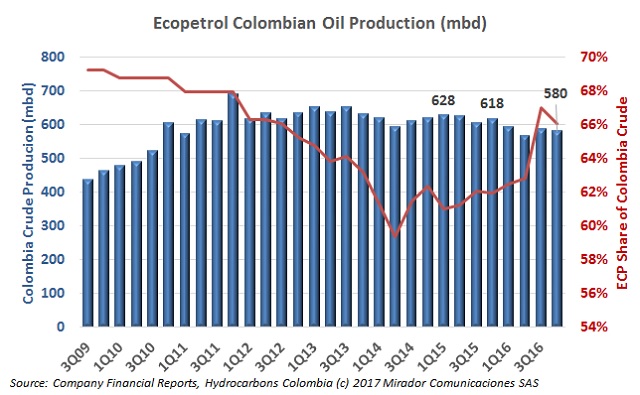

Ecopetrol (NYSE: EC) made public its financial results for 2016. The company notes that it did well despite the difficult circumstances. The NOC exceeded its production target and presented positive financial results.

Ecopetrol (NYSE: EC) begins the year with several challenges to face and overcome. The company expects to start recovering after two difficult years. With an oil price above US$50, prospects are more optimistic.

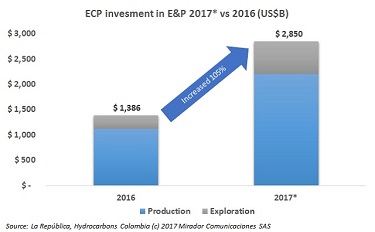

The crude price fall caused large reductions in budgets and investments worldwide. Oil firms are beginning to recover from this period and so they are investing again. The increase in Ecopetrol’s investment budget is the highest in the world.

The crude price fall caused large reductions in budgets and investments worldwide. Oil firms are beginning to recover from this period and so they are investing again. The increase in Ecopetrol’s investment budget is the highest in the world.

The enhanced oil recovery strategy to increase production in the country and fields profitability is being successful. Ecopetrol (NYSE: ECP) has announced that several projects are going well.

Ecopetrol (NYSE: EC) reported its reserves as of December 31, 2016, declaring yet another a decrease this time compared to 2015. The Reserves Life Index (RLI), as expected, also fell. Ryder Scott Company and DeGolyer & MacNaughton audited the majority of reserves (99%).

Ecopetrol (NYSE:EC) was ranked 454 among the 500 most valuable brands in the world in 2017. This is three positions above last year’s rank, where the NOC was number 457 in international Brand Finance’s classification.

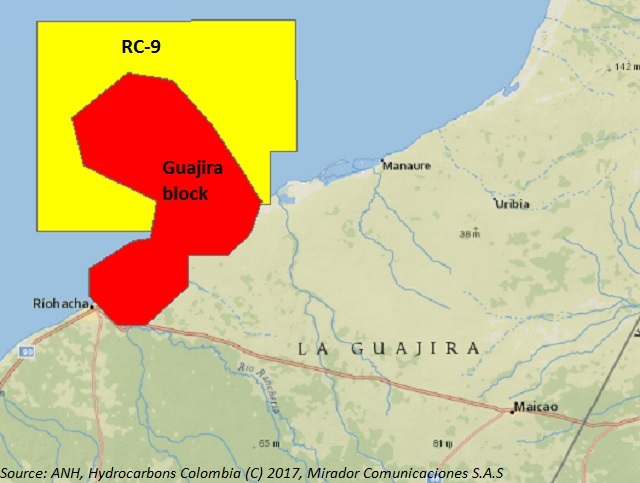

Colombia is optimistic about increasing its production offshore. Ecopetrol (NYSE: EC) announced that it will start drilling an offshore well in the second quarter of this year. The NOC becomes the first Colombian oil-company to carry out an offshore hydrocarbon project on its own.

Juan Carlos Echeverry, CEO of Ecopetrol, released some results of the “transformation plan” to address low oil prices. This program started two years ago and its results are very positive in a very short time.

The NOC wants to achieve 715mbd in production, as well as increase exploration in Colombia and Mexico, where last year the Warrior discovery took place.

Ecopetrol (NYSE: EC) has been strengthening its transport business in recent years. The Colombian company has great plans for this corporate area since it has become one of the most profitable.