The Ministry of Environment (MinAmbiente) announced that it is finalizing the rules for the development of this technique in Colombia.

The NOC is working on improved recovery programs to continue increasing its proven reserves.

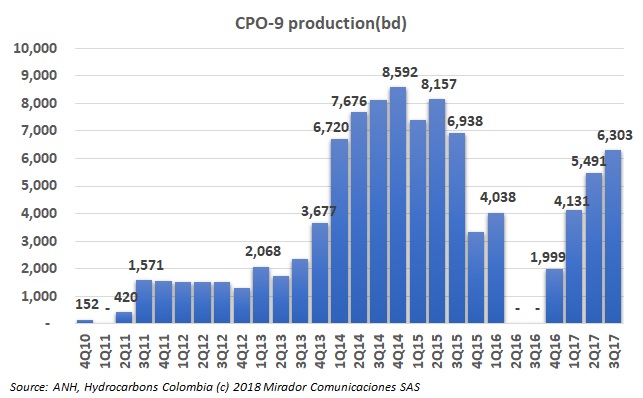

Ecopetrol (NYSE: ECP) announced an oil discovery in its CPO-09 block, in the municipality of Guamal (Meta). The NOC has a 55% stake in the project and its partner, Talisman Colombia Oil & Gas, (Repsol) has the remaining working interest.

Felipe Bayón, CEO of Ecopetrol (NYSE: ECP), spoke about the company’s recent oil discoveries, their relevance and the firm’s plans for this year.

Ecopetrol (NYSE: EC) announced its fourth quarter and full-year 2017 results. The firm highlighted that net income was the highest of the past four years. The NOC’s reported margins are at their highest in the past two years.

Minister of Mines and Energy (MinMinas), Germán Arce, spoke about terrorist attacks on Coveñas-Caño Limon (CCL), acts of vandalism against Ecopetrol’s (NYSE: EC) infrastructure, and the controversies surrounding unconventional projects.

Ecopetrol (NYSE: ECP) announced its investment budget for social and environmental projects in 2017. The company highlighted that most projects will be carried out this year, benefiting the development of communities and regions in the country.

Ecopetrol (NYSE: EC) reported its reserves as of December 31, 2017. The NOC managed to report positive results despite social problems, attacks on its infrastructure and low prices during the past year.Ryder Scott Company and De Golyer & Mac Naughton audited the majority of reserves (99%).

The president of the National Hydrocarbons Agency (ANH), Orlando Velandia, spoke about oil prices, production targets and other industry metrics for this year.

Ecopetrol’s (NYSE: EC) export distribution is changing, but the United States remains as the principal destination of Colombian crude. The company said that exports decreased as the Cartagena refinery is using more oil.