Ecopetrol (NYSE:EC) and Equion spoke about the development of successful programs in departments like Casanare and Putumayo, among others. These and other Corporate Social Responsibility (CSR) stories in our periodic summary.

The government of Juan Manuel Santos is ending and the Ministry of Mines and Energy (MinMinas) delivered a report on the energy sector’s performance in the last eight years. Germán Arce Zapata, MinMinas, presented the results at an event in the municipality of Guapí, Cauca.

In recent years, the Coveñas Caño Limón pipeline has been the main target of illegal groups, especially the ELN. This year this important facility has suffered several attacks, affecting its normal operations and Ecopetrol (NYSE: EC) is working to repair the damage.

Current oil prices have generated many expectations in the oil sector to recover the ground lost during the last years. Companies have announced several investments and Ecopetrol (NYSE: EC) has big plans in this area.

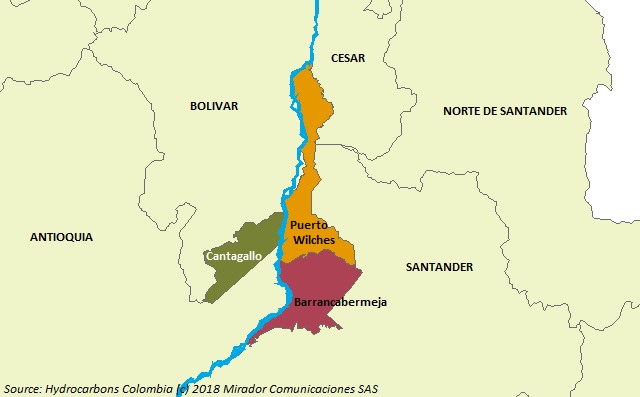

Ecopetrol (NYSE: EC) reported in new oil spill in Colombia, this time the Magdalena river is affected. The NOC announced the activation of a contingency plan to deal with this situation.

The Works for Taxes program is one of the most interesting ideas by the Colombian Government that we have seen in a long time. This program began with several projects and a large budget approved by the Superior Council of Fiscal Policy (CONFIS).

The Colombian Association of Petroleum Engineers (Acipet) spoke about its concern regarding the treatment that some of Ecopetrol (NYSE: EC) engineers received after the incident in La Lizama.

The companies spoke about successful projects that have benefited communities in the departments of Huila, Arauca and Casanare, among others. These and other Corporate Social Responsibility (CSR) stories in our periodic summary.

Ecopetrol (NYSE:EC) CEO Felipe Bayón did an interview on local television recently, addressing Reficar, La Lizama and Presidential candidate Gustavo Petro’s alternative view of the oil industry.

About a month ago, one of the country’s leading business newspapers, published an article on Ecopetrol’s (NYSE:EC) results with the brilliant title “Ecopetrol does not give up its position as the leader in hydrocarbons”. Considering that the NOC produces ten times what the next company does this does not show a lot of insightful analysis on the part of the headline writer.