Colombia is looking for alternatives to improve its production and reserves metrics and the Enhanced Oil Recovery (EOR) technique is one of the main strategies to achieve it. Ecopetrol (NYSE: EC) is implementing EOR in its fields with good results.

The union quoted Sentence 796 of 2014, among others, to defend its right to ‘defend their rights’.

The Colombian Corporation of Agricultural and Livestock Research Corpoica (Agrosavia), investigated the Ecopetrol (NYSE: EC) treated produced water of with positive results.

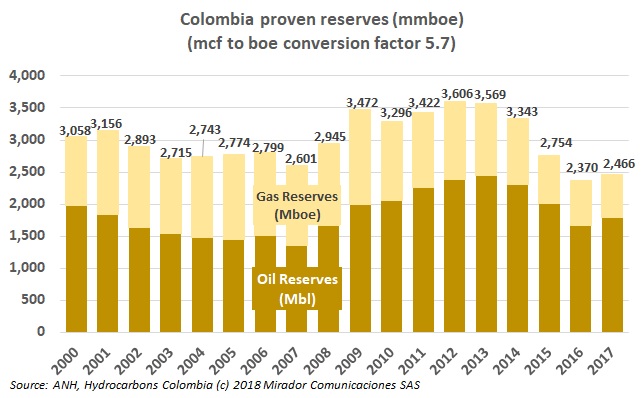

Felipe Bayón, CEO of Ecopetrol (NYSE: EC), spoke about relevant issues to the sector such as investment, fuels, unconventional resources, and reserves, among others.

A fracture in the TransAndino pipeline caused an environmental emergency in Puerto Boyacá (Boyacá). Local locals warned about the dumping of a considerable amount of oil in the area. The development of these and more stories in our periodic Eco summary.

The NOC spoke about ‘Pionero 500’; the new technology that can potentially change offshore activities in Colombia.

The Minister of Mines and Energy (MinMinas), German Arce, spoke about the development of successful projects that have been possible thanks to the presence of the industry in Colombia. These and other stories in our periodic Royalties summary.

Ecopetrol (NYSE:EC) and Equion spoke about different social investment projects that were developed in their areas of influence, highlighting positive results. These and other Corporate Social Responsibility (CSR) stories in our periodic summary.

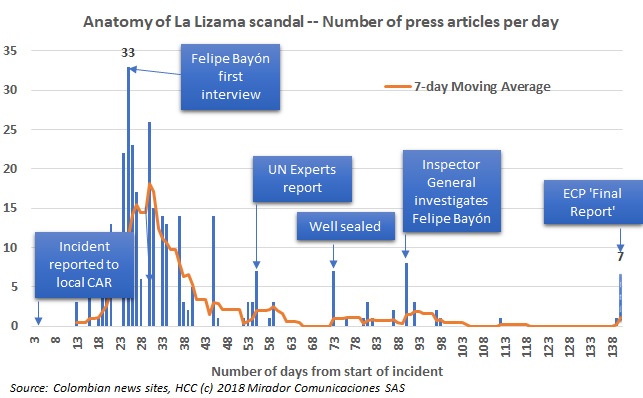

The minor oil spill from the Lizama well generated a controversy between environmentalists, inhabitants and people against the sector. Ecopetrol (NYSE: EC) announced the actions taken to compensate for the damage.

The union announced that it submitted the list of requests to Ecopetrol´s (NYSE:EC) management, to start negotiations of a new Collective Labor Agreement.