The government announced that the savannas of Cinaruco (Arauca) are now part of the list of protected areas in Colombia. The development of these and more stories in our periodic Eco summary.

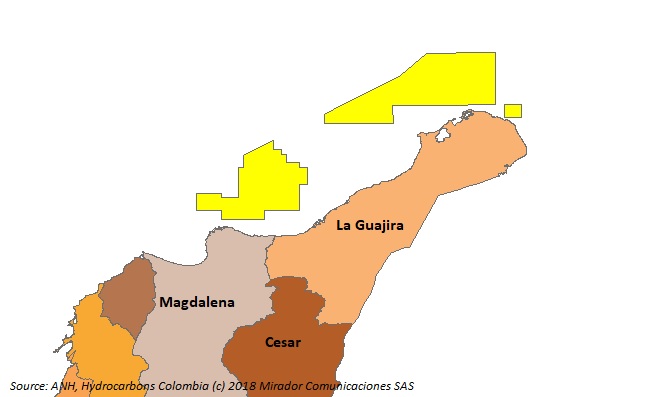

Ecopetrol (NYSE: EC) is developing several offshore projects in the Colombian Caribbean and expectations are high, especially in terms of natural gas. Felipe Bayón, CEO of ECP, spoke about the Orca-1 well and other issues relevant to the NOC.

The president of the National Hydrocarbons Agency (ANH), Orlando Velandia, spoke about prospects and projects for the sector in the first half of the year, among other topics.

Ecopetrol (NYSE: EC) is betting on offshore projects in Colombia and abroad to improve its long-term prospects. The NOC plans to increase its presence in Latin America.

Ecopetrol (NYSE: EC) announced its energy plans for key oil fields in Colombia. The company has great expectations about the results of this strategy.

According to the NOC, local hiring levels increased 24% during the first semester of 2018, compared to the same period last month.

The union’s president, César Loza, spoke with the press about what he wants to achieve through the negotiations.

Oil companies are diversifying their portfolios and the industry associations say the petrochemical business has positioned itself as one of the most attractive alternatives.

Ocensa, Geo Park (NYSE:GPK) and Ecopetrol (NYSE:EC) spoke about the successful development of social investment projects in their areas of influence. These and other Corporate Social Responsibility (CSR) stories in our periodic summary.

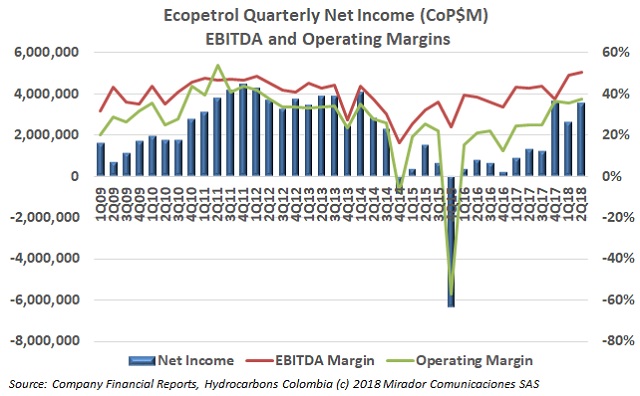

Ecopetrol (NYSE: EC) announced its second quarter 2018 results. The NOC financial performance considerably increased compared to previous year, proving that the company is levering current oil prices.