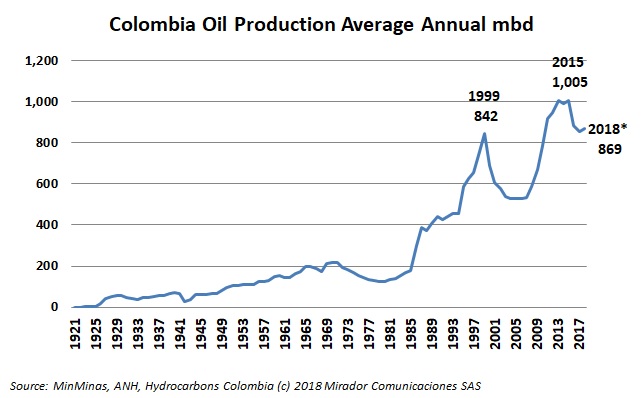

The First Oil and Gas summit: 100 years promoting the development of Colombia brought together important representatives of the industry. They recalled the history of the sector in Colombia.

Ecopetrol (NYSE: EC) has big plans for the refining sector in Colombia. The company announced the creation of its Integrated Refining System (SIR) to improve its operations in this industry.

The Senate’s Fifth Commission will soon decide on three projects that could potentially ban fracking in Colombia. Industry experts spoke about what could happen if authorities close the doors to unconventional resources.

Colombia’s Natural Gas Association (Naturgas) spoke about the effects of the State Council’s decision to suspend existing fracking regulation.

Ecopetrol (NYSE:EC) announced that it activated a new contingency plan in the Coveñas Caño Limon (CCL) pipeline, after authorities reported an attack in Norte de Santander. The development of these and more stories in our periodic Eco summary.

During the political control debate that took place in Senate’s Fourth Commission, Senator and president of that Commission, Nicolás Pérez, spoke about Ecopetrol’s (NYSE: EC) assets and Colombia’s finances.

National USO representative, José Marín Moreno, spoke about the new government and Ecopetrol’s (NYSE:SE) future, among other issues.

The new head of the National Hydrocarbons Agency (ANH), Luis Miguel Morelli, spoke about the entity’s plans for the coming years.

Once again, the NOC showed the benefits of the industry in the country, this time by granting scholarships to Colombia’s best students. These and other Corporate Social Responsibility (CSR) stories in our periodic summary.

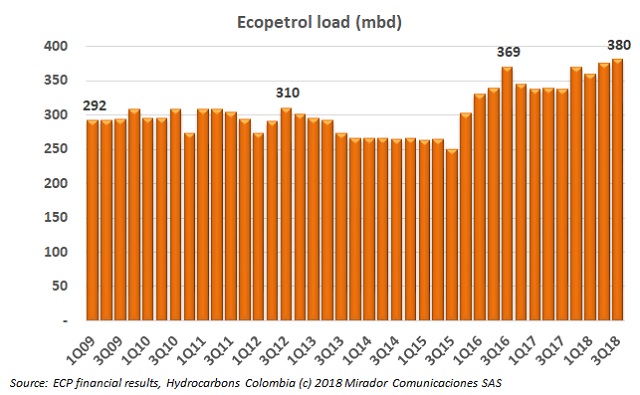

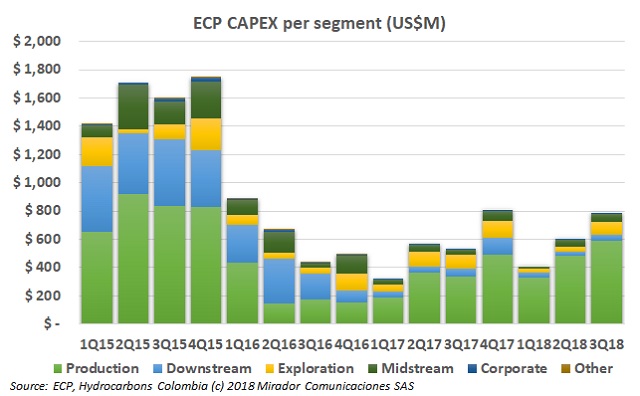

Ecopetrol (NYSE: EC) has managed to report good financial results during this year, taking advantage of current oil prices. This situation has left the company in a favorable position to increase investments. Felipe Bayón, CEO of ECP, spoke about the company’s investment plans.