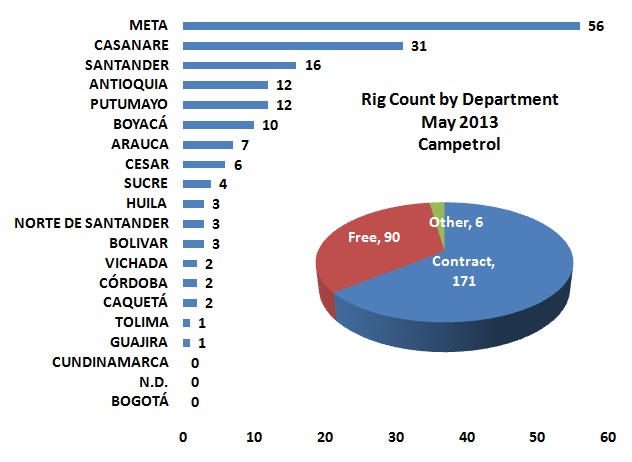

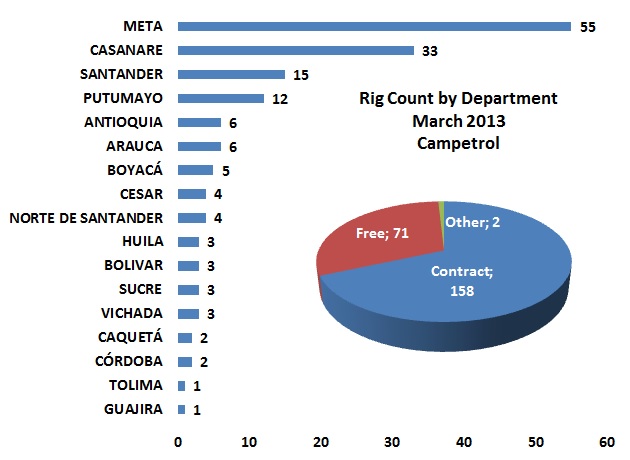

Drill rig counts have become controversial with Baker Hughes showing recent declines — suggesting something was not right — and the Ministry of Mines and Energy taking offense at the implied criticism. Campetrol’s counts are based on its members’ reports and, to the extent that they represent the universe of drilling companies, should be more representative.

Canacol Energy says it has started drilling an exploration well as part of its Oso Pardo I expedition project carried out jointly with ConocoPhillips.

Presidents of the community action boards of Tauramena and Villanueva, two villages that fall within the influence area of the “Llanos 32-34 and 3D Max” seismic exploration program, attended a meeting with the companies to define agreements surrounding social investment, wage, transport and monitoring.

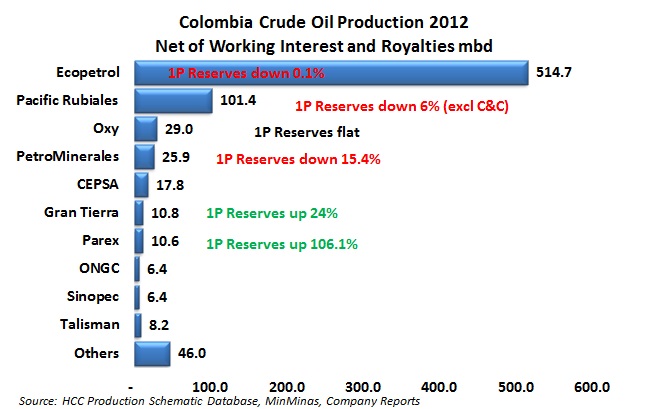

The country’s reserve report for 2012 has been much anticipated because prior signals were not very positive. Government officials publicly worried about reserve-production ratios as did the Colombian Petroleum Association (ACP). The three of the largest companies (Ecopetrol, Pacific Rubiales, Petrominerales) did not have good years for oil exploration in Colombia. We think ‘Small Oil’ made up the difference. Overall, this is good news but our commentary points out that there is still much to do. From a MinMinas press release, translated and with commentary by Hydrocarbons Colombia

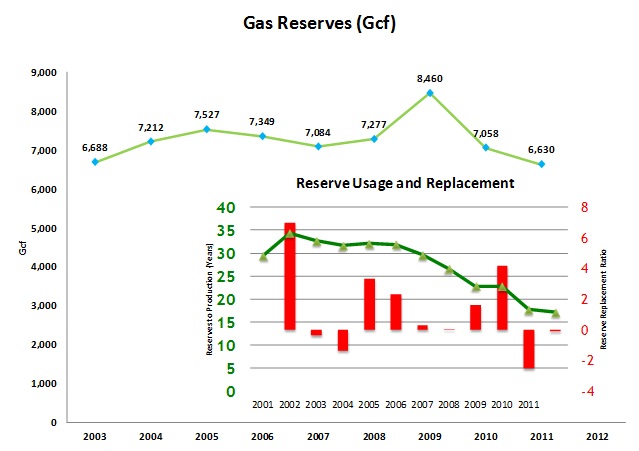

Santiago Angel Urdinola, VP of Mining, Oil and Energy, of national business persons association ANDI gave a speech where he suggested that the country might experience shortages and rationing by 2019. This got Naturgas – the association that represents natural gas distributors, transporters and producers – upset and they issued this press release. Translated and with commentary by Hydrocarbons Colombia.

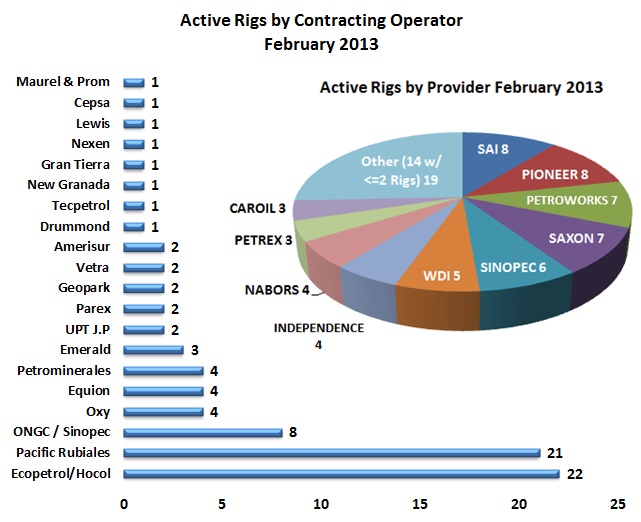

Service company association Campetrol’s rig counts are up between this survey which is just labeled ‘March, 2013’ and the last figures which were labeled ‘February 13th, 2013’. There are three more under contract and 1 more ‘Free’. That is a positive sign although we are coming into the first half ‘winter’ season when drill rig movements slow down considerably.

France’s EFE news agency interviewed Oscar Villadiego, board chairman of the Regional Association of Oil, Gas and Biofuels Industry in Latin America and the Caribbean (ARPEL). Villadiego said that Latin America and the Caribbean form a region “full of opportunities” to produce hydrocarbons, adding that “more space should be given to new technologies to better and more dynamically develop these resources.”

Yesterday we published a calculation that the country needed something like 350 exploratory wells to have a good chance at reserves remaining flat with production at 1Mbd. This number is 2.7 times the record number of exploratory wells achieved last year. It was not an opinion, it was a calculation based on recent statistical evidence. Now today the National Hydrocarbons Agency (ANH) announces it is lowering – not raising – its expectations for exploratory drilling, for this year and next. From the ANH website, translated and with commentary by Hydrocarbons Colombia.

We will report separately on MinMinas Renjifo’s comments to the annual CWC Colombia Oil & Gas Summit and Exhibition in Cartagena but there was a lively forum on exploration that got to the heart of the country’s current problems with reserve growth. The issue for the industry participants in a round table and especially for Talisman’s Chris Spaulding and Gran Tierra’s Duncan Nightingale is that Colombia is not drilling anywhere close to enough wells.

Statistical snapshots can be misleading – those with only one rig active might have just released several or have several ready to be activated in March – but the big numbers are probably stable. It is no surprise that Ecopetrol should be the largest but perhaps surprising that Pacific Rubiales should be so close. It is perhaps surprising that Gran Tierra has so few or that Canacol is not on the list (it is the operator for five exploration blocks and three production blocks). For those surprised to see coal operator Drummond on the list, it has permits for Coal Bed Methane exploration.