A technical issue caused the original article to have incorrect conclusions. It has been re-issued here. We apologize for any misunderstanding this might have caused.

Charle Gamba, president of oil producer Canacol Energy (TSX: CNE.T) said that unconventional oil resources have the potential to extend Colombia’s proven reserves to 15-25 years, compared to the 7 years of reserves registered today.

The mayor of Puerto Rico, in the Caquetá Department, says that Ecopetrol (NYSE: EC) is ready to start seismic explorations in the area, bringing oil production to the region. But how will this be received by the community?

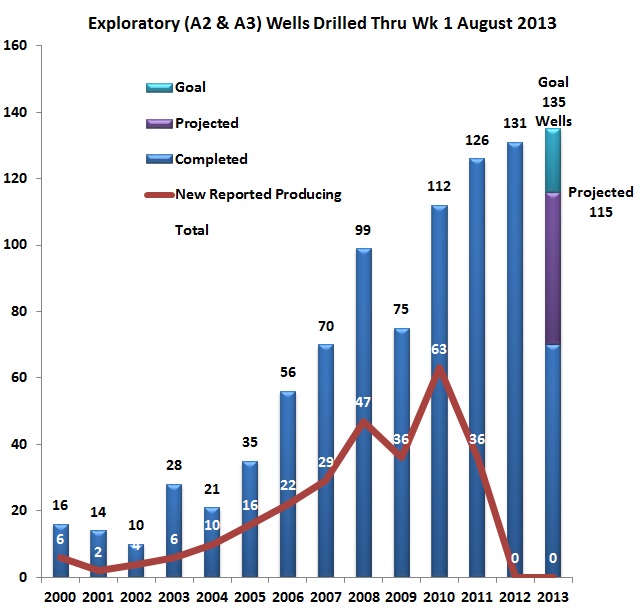

Despite running short of 2013 goals for exploration wells the president of the National Hydrocarbons Agency (ANH) Germán Arce said that the government has decided not to start off shore exploration activities in the San Andrés islands.

In the transition from a state operated monopoly to a mixed scenario with private players Mexico must find ways to be competitive globally and encourage sustained private investment in exploration says Germán Arce, president of Colombia’s National Hydrocarbons Agency (ANH).

Last week Petrominerales published its 2Q13 and while there was some good news from Brazil and new heavy oil finds, the overall production picture continued its decline. The company produces only about half the crude it did at the beginning of 2011.

The National Hydrocarbons Agency (ANH) is preparing a campaign to push through regulations that would allow exploration for unconventional reserves in areas that have already received approval for conventional extraction.

Pacific Rubiales has come across the remains of an indigenous group that date back 700 years in what now is an exploratory block.

The Tabasco Oil company, which is majority owned by the investment group of Mexican billionaire Carlos Slim, Grupo Carso, says it has discovered oil in an exploration block in northeastern Colombia. However, difficult community relations may limit their ability to fully exploit the opportunity.

Officials charged with managing Colombia’s sea commerce and resources met with oil companies performing offshore exploration to discuss regulations surrounding the activities.