The Colombian Minister of Mines and Energy, Amylkar Acosta, heralded an optimistic view for 2014, saying that not only are investors continuing to believe in Colombia’s potential, but also a potential record of exploratory wells, some 240, will be drilled this year.

Peru’s Mines and Energy Eleodoro Mayorga has announced that the government will eliminate the requirement for environmental impact studies for seismic exploration to encourage investment, a move that could mean more interest in the Andean country over the complexities of seismic exploration in Colombia.

Mansarovar Energy has abandoned a seismic exploration project near the Villavicencio municipality after opposition from local authorities and community members.

As part of the Colombia Round 2014, the government wants to see greater activity in off shore deep water drilling, and the issue is one of the main objectives of the National Hydrocarbons Agency (ANH) for the upcoming bidding.

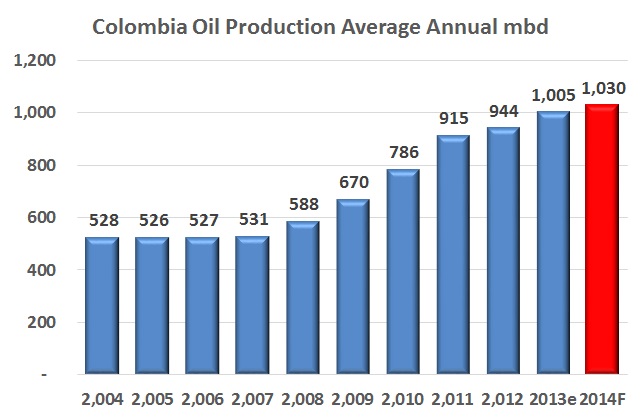

The Colombian Petroleum Association (ACP) says growth next year will only be 2.3% which means a projection of 1.03mmbd versus the expected result for this year of 1.006mmbd. The graph shows this means fairly flat growth.

The Municipality of Tauramena, Casanare held its public referendum on Sunday, December 15th and those who came out voted a sounding no, although the total turnout amounted to just over 34% of the population, narrowly passing the 33% turnout needed for the vote to be valid.

The government engaged a multi-pronged push back against a public referendum that looks to reject oil production near municipal water sources in Tauramena, Casanare which included ministers and Ecopetrol’s (NYSE:EC) president Javier Gutiérrez.

Ecopetrol (NYSE:EC) and Talisman announce commercial viability in CPO-09 block, which will add 35 million barrels of reserves and marks the second addition by the NOC in as many weeks.

Ecopetrol (NYSE:EC) has declared to Colombia’s National Hydrocarbons Agency the commercial viability of the Eastern Caño Sur block, adding 22.4 million barrels of 1P reserves.

The Colombian government, by way of the Ministry of Mines and Energy (MinMinas) signed a memorandum of understanding with the US government in Washington DC to cooperate on energy matters.