ANH President Mauricio de la Mora was practically exuberant at a ceremony in the ANH’s offices on Wednesday. And why not? Canacol (TSX:CNE) and ConocoPhillips (NYSE:COP) were signing the agency’s first additional unconventional contract and victory had been snatched from the jaws of defeat.

The former Vice-Minister and of Energy and former president of the National Hydrocarbons Agency (ANH) Orlando Cabrales has spent less time in public eye since leaving his post last year, but recently penned a critical article on the factors that have led Colombia to a shortage of natural gas.

The president of the Colombian Chamber of Oil Goods and Services (Campetrol) Rubén Darío Lizarralde warned attendees at an event in Barrancabermeja that Colombia’s proven reserves are enough to last for only six more years, and the current government strategy will not do much to change that. Ecopetrol (NYSE:EC) then responded.

Ecopetrol (NYSE:EC) president Juan Carlos Echeverry has in the past defended what others consider high taxes on oil companies, but in a recent report a national radio chain says he sees the nearly 70% state take as being a barrier to foreign investment, affecting in particular exploration wells.

The National Hydrocarbons Agency (ANH) president Mauricio de la Mora outlined the entity’s goals in a meeting with the business sector and said that it expects 28 to 32 exploratory wells this year.

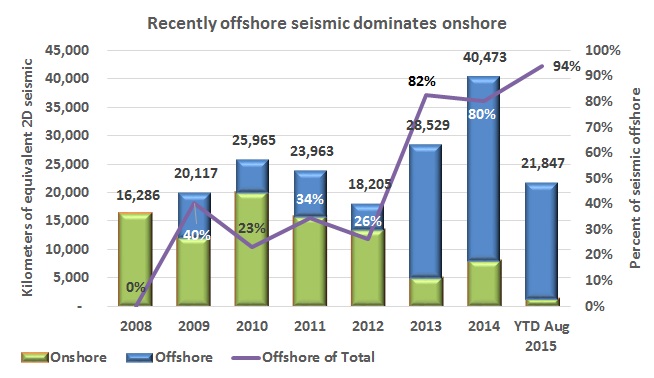

While Caribbean offshore blocks have received attention and been the site of recent discoveries, Pacific blocks have failed to gain the same interest and results. Now the National Hydrocarbons Agency (ANH) is looking to hold a competitive process in 2016 to find operators.

ONGC Videsh (OVL), the subsidiary for foreign investments of Indian NOC ONGC, is executing an investment of more than US$72M in a first phase of exploration in three offshore blocks in the Colombian Caribbean.

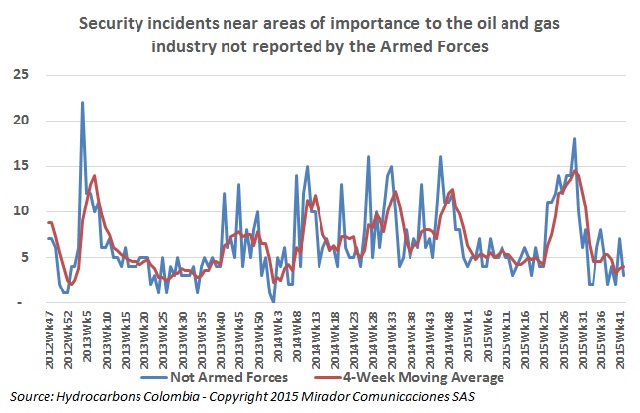

A regional military publication profiled the Colombian armed forces troops assigned the task of protecting the nation’s pipelines from guerrilla attacks, and detailed some of the collaboration with other government agencies on the environmental cost.

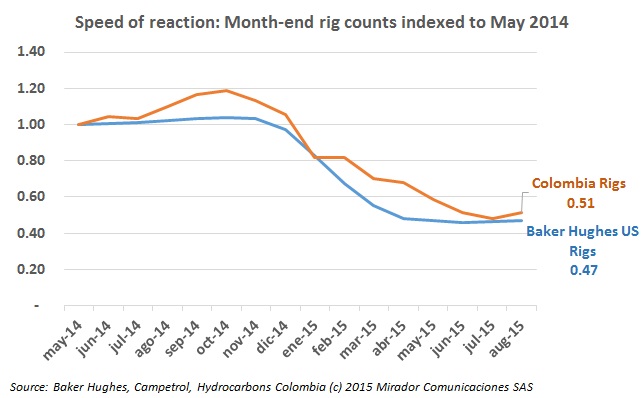

The Baker Hughes US rig count is more than ten times higher than the Colombian count so we indexed the month-end counts to see trajectories and measure speed of reaction to the dramatic decline in crude oil prices since last June 2014.

The president of the Colombian Chamber of Oil Goods & Services (Campetrol), Rubén Darío LIzarralde warns that “he who does not explore, does not produce”, citing a 19% drop in exploration investments among the eight largest operators in 2015.