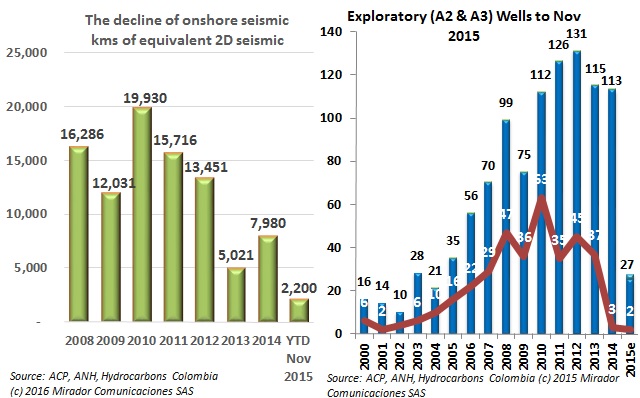

A recent report from the Chamber of Oil Goods and Services (Campetrol) calls attention to the fact only one of every four drills in Colombia were in use in Colombia, and urged the government to do more to stimulate exploration.

Another depressing figure has been released by the National Hydrocarbons Agency: in 2015 operators only made 17 registered discoveries, a 39% fall compared to the 28 announcements in 2014.

The Chamber of Energy Goods and Services (Campetrol) published an analysis in which it found that calculations of Colombia’s reserve life are much lower due to the fall in oil prices, and do not even extend for five years.

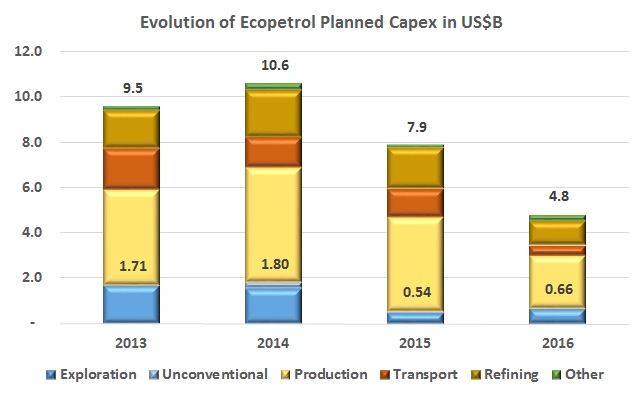

The Colombian Chamber of Oil Goods and Services (Campetrol) published an analysis of how Ecopetrol’s (NYSE:EC) exploration budget has shifted to market conditions over the last several years, and urged the NOC to step up exploratory efforts and spending.

Figures from the National Hydrocarbons Agency (ANH) confirm what many have said since the middle of last year: 2015 was a dreary year for exploration. But as if the drop in numbers was not enough, the success rate of these wells fell even further.

We have not published our ‘Fracker Tracker’ since early December when news of ExxonMobil’s (NYSE:XOM) application for permission to frack and the signing of an unconventional contract with ConocoPhillips (NYSE:COP) and Canacol (TSX:CNE) had pushed positive press reports to heights not seen for some time. However, this positive press has melted away as the graph shows.

The service industry and members of the Colombian Chamber of Oil Goods and Services (Campetrol) have suffered over the last year, with 38 service firms filing for bankruptcy protection and 40,000 jobs lost. Its president Ruben Dario Lizarralde urged Ecopetrol (NYSE:EC) to continue exploring for the good of the country.

The Colombian Association of Oil Engineers (ACIPET) believes that the main focus of the industry and authorities this year should be to add 1B barrels of new crude reserves in order to position the sector for an eventual recovery of oil prices six or seven years down the road.

The Colombian Petroleum Association released the results of a study on investment trends and found that the tax reform of 2014 has led to a poor investment climate which has resulted in a 28% fall in CAPEX in 2015 when compared to the year prior, with exploration taking the biggest hit.

An absence of exploratory results from the hydrocarbons industry is likely to extend until 2017 warns the National Association of Financial Institutions (ANIF), and Ecopetrol’s (NYSE:EC) results will continue to suffer despite production increases, representing a loss of between 1-2% of the GDP.