Controversy over ConocoPhillips (NYSE:COP) project in Cesár has brought unconventional technologies back into the press limelight and the balance has not been positive.

The Colombian Oil Engineer Association (ACIPET) said that focusing on the established resources and potential exploration projects must also include an effort to better inform communities and counter misinformation being given about oil activities.

The Colombian Petroleum Engineers Association (Acipet) and the National Hydrocarbons Commission (ANH) organized a two-day seminar called “Near Field Exploration” in Bogotá. HCC was present at the event; we bring a brief summary of the meeting.

In order to evaluate the size of the discovery made at its offshore Kronos-1 well, Anadarko (NYSE:APC) will start drilling its Purple Angel-1 well at the end of December.

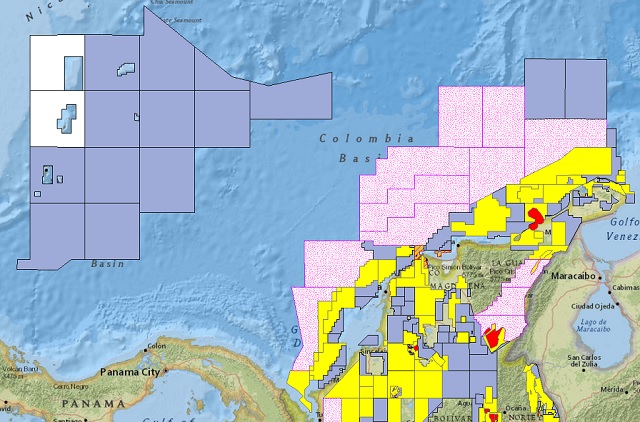

The Minister of Mines and Energy Germán Arce said that the Caribbean region has the greatest prospectively for both onshore and offshore exploration of hydrocarbons, and represents the future of the industry.

The Minister of Mines and Energy Germán Arce said that the government will have the hydrocarbons sector in mind when drawing up its tax reform, to accelerate and reactivate exploration activities.

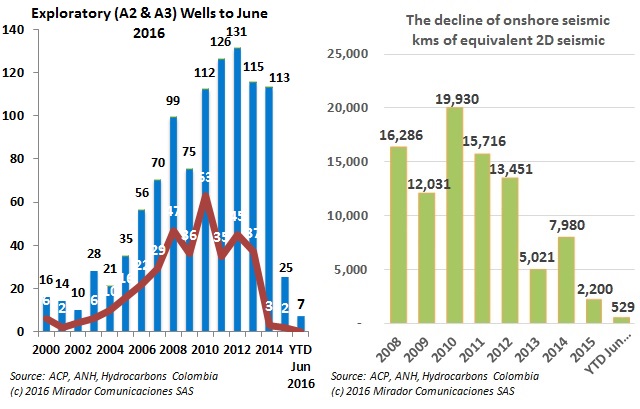

Improved oil prices have not done much to improve exploration activity in Colombia which is far short of past years and seismic activity has mostly been offshore. However according to the Colombian Petroleum Association, the activity could still meet with the association’s goals for the year.

The departments of Caquetá and Putumayo will see a greater concentration of exploration and production activity, and will likely be included in the upcoming Colombia 2016 round.

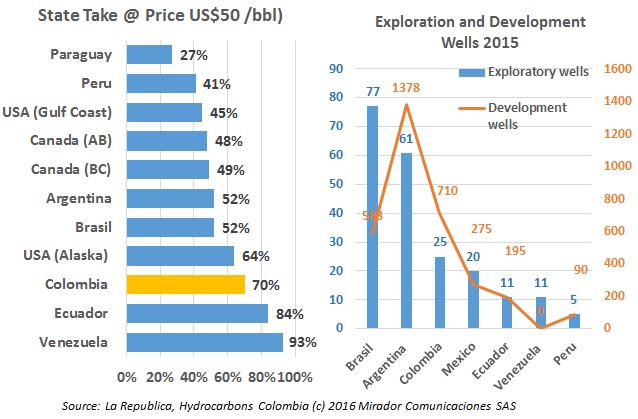

A report in a national paper caught our eye, as it trumpeted the fact that Colombia ranked third in Latin America when it comes to exploration activity, and that “only Brazil and Argentina were ahead of Colombia in terms of exploration wells”.

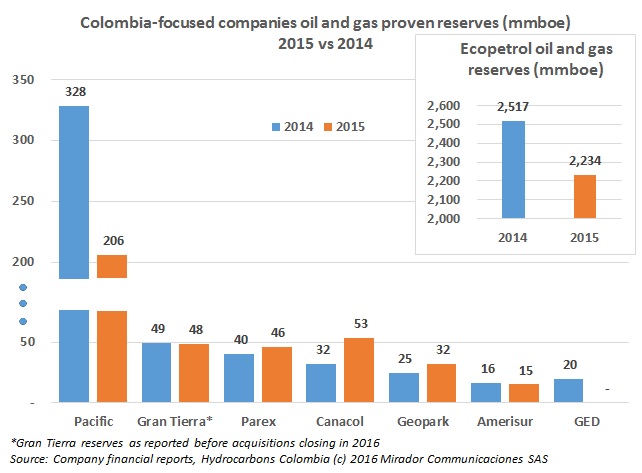

The Colombian Chamber of Oil Goods and Services (Campetrol) published an analysis of global oil operators and found several examples of firms which were able to reduce costs, but still invest in E&P and grow reserves. However, it said Ecopetrol (NYSE:EC) was not one of them.