Colombia is not an oil-country but has the potential to be self-sustaining in the medium and long term, according to a study of the Geo Sciences Department of the National University. Carlos Alberto Vargas Jiménez led this research.

Colombian authorities are betting on offshore projects to cover at least part of the natural gas supply gap in next decade. Several companies have shown interest in this kind of project in Colombian waters.

Colombia is optimistic about increasing its production offshore. Ecopetrol (NYSE: EC) announced that it will start drilling an offshore well in the second quarter of this year. The NOC becomes the first Colombian oil-company to carry out an offshore hydrocarbon project on its own.

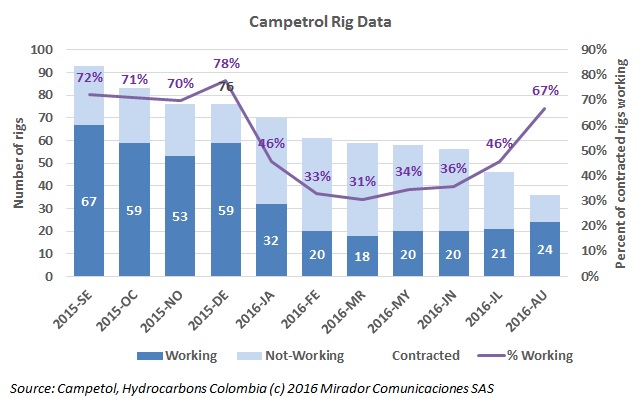

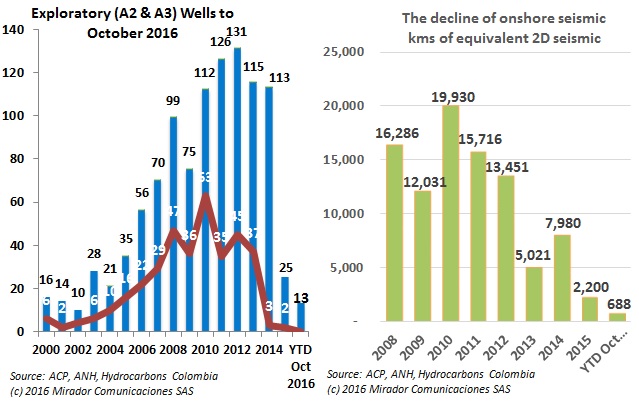

The Colombian Petroleum Association (ACP) hopes to see a rebound in the sector in 2017 after concluding a negative year in 2016 which saw a steep fall in prices, lower production, investment and exploration.

The National Hydrocarbons Agency (ANH) expects oil price improvements to give a boost to exploration activities in 2017, and that in Colombia there will be more than 40 exploratory wells next year.

Still dealing with stubborn opposition for trying to bring legitimate economic activity to the same time-zone as Caño Cristales and some of the country’s best coca-growing areas, Hocol released a statement to the press on its project in San Juan de Arama.

Even with its environmental licenses approved and delivered, Hocol is facing stiff resistance from communities in La Macarena, Meta which accuse the firm of downplaying its project and putting water resources at risk.

As the Brent oil price pushed above US$53 on Thursday, there is hope that 2017 will see a recovery of exploration and drilling activity.

A report issued by the Colombian Petroleum Association (ACP) showed that between January and June, only nine exploration wells have been drilled, with one in the process of construction. This amounts to 27.2% of the industry’s goal for the year, which had been set at 33 wells.

A public hearing in the Pesca Municipality of Boyacá for a seismic campaign by Maurel & Prom has again received strong community resistance after local leaders and environmentalists allege it would lead to a drought.