The National Hydrocarbons Agency (ANH) spoke about what must be done to assure the success of the industry in Colombia.

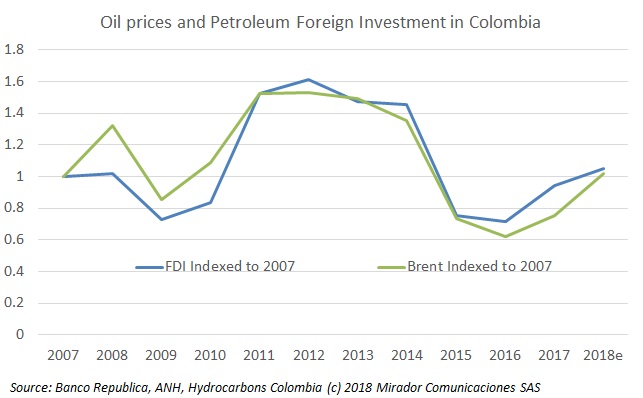

This week we skip our ‘Last 8 years’ qualitative feature in favor of a guest contribution but we continue the series in our quantitative analysis column. Last week we looked at turnover in key policy positions. If policy instability put off investors, we would expect it to show up in investment and exploration statistics, which is what we look at here.

The Congress must decide what will happen with the bill that seeks to ban fracking in Colombia. Carlos Andrés Santiago, promoter of the project, spoke on the matter.

The Colombian government is making an important commitment to promote the development of offshore projects and take advantage of the Caribbean Sea potential. This has generated high expectations in the Caribbean region of the country, especially in the department of Atlántico. There, leaders are discussing about how to leverage these opportunities and their risks.

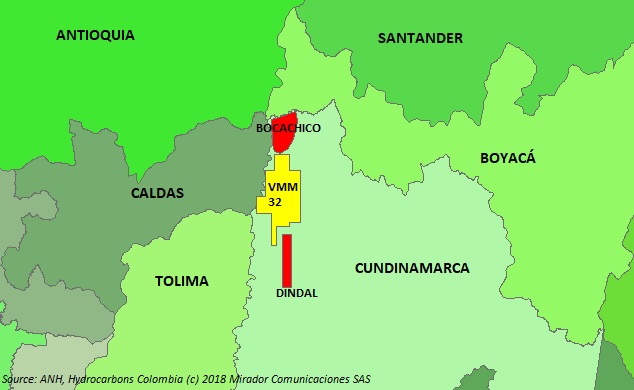

Ecopetrol (NYSE: EC) continues to develop exploration activities in Colombia and it seems like the strategy is on the right track. The NOC announced a new discovery in the department of Cundinamarca.

The governor of Boyacá, Carlos Amaya, called for the temporary and immediate suspension of a contract for an alleged fracking project in the department, and asked the National Hydrocarbons Agency (ANH) to educate the community about it.

Colombian authorities want to boost the oil exploration and production in the country to guarantee energy self-sufficiency over the long term. The National Hydrocarbons Agency (ANH) announced projects to achieve this goal and the Tax Refund Certificate (CERT) plays a key role.

The General Maritime Directorate organized a workshop for those who will be inspecting offshore platforms. ANH President Orlando Velandia was invited to talk about the offshore oil and gas opportunity.

Mansarovar Energy’s Executive Vice President of Corporate Affairs, Carlos Benavides, spoke about the firm’s plans in Colombia.

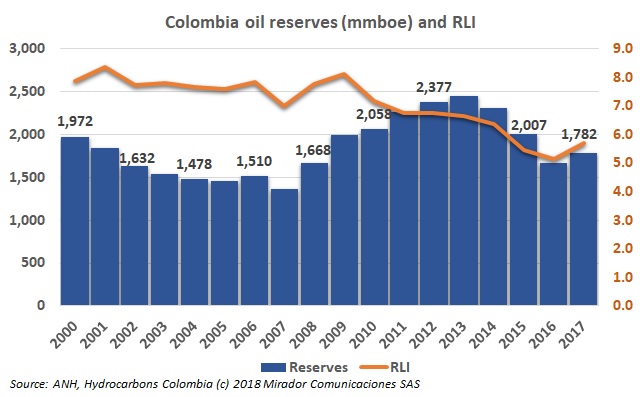

The Colombian oil sector faced tough times due to low oil prices and social conflict, but the industry managed to overcome this challenges and it is recovering lost ground. The Ministry of Mines and Energy (MinMinas) and the National Hydrocarbons Agency (ANH) reported Colombia oil reserves in 2017, with positive results.