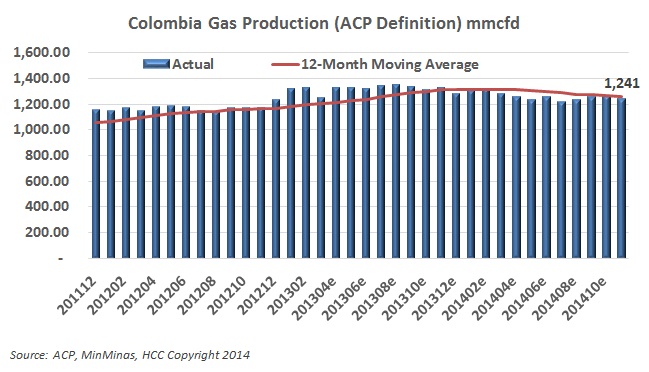

The attention always goes to crude oil production which gets the headlines. But there are worrisome trends in gas production as well.

With oil prices falling, investment for new projects from foreign investors is being pinched, which will leave its mark on Colombia and the country’s ability to compete for attention in a market where supply overwhelms demand.

Terpel’s Gazel chain says that it expects that within 5-10 years there will be up to 30,000 buses and trucks running on natural gas instead of diesel.

The government’s formula to fix gasoline prices aims for stability despite changes in the international price of oil, for better or worse. But some are questioning who is benefiting when oil prices have dropped over 20% in the last six months, but fuel prices less than 2%.

With two new large biofuels refining plants planned for 2015 and 2016 and regulations that will increase the ethanol mixture in gasoline to 13.6% next year, the consumption of biofuels could grow by more than 50% in two years, says the president of the National Fuels Federation (Fedecombustibles) Jorge Bendeck.

The former Ministry of Mines and Energy, Amylkar Acosta, says considering the decrease in oil prices Ecopetrol (NYSE:EC) and the industry must lower costs and guarantee a functioning pipeline system in this new scenario.

Government officials have taken a new tone this week, insisting that Colombia is prepared for lower oil prices and that the fiscal budget’s long term fundamentals remain strong.

Ecopetrol (NYSE:EC) is by no means the only Colombian oil exporter but it publishes the most detailed statistics and we believe its export patterns indicate how the market as a whole is shifting.

The Minister of mines and Energy (MinMinas) Tomás González paid a visit to Yopal, Casanare and outlined the root causes of the drop in oil prices, and also talked about exploration plans to grow reserves and production.