The Minister of Mines and Energy Tomas González and business representatives grouped under the National Business Owners Association (ANDI) in the Caribbean coast have agreed to review the formula and increase in natural gas rates that had been planned for November 30, 2015. It is not the first time that MinMinas has balked on price adjustments due to political outcry.

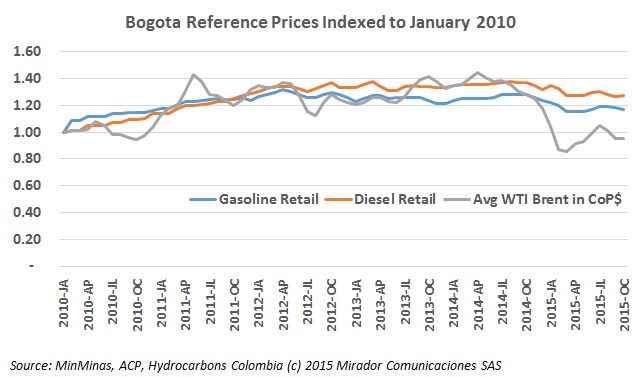

Both gasoline and diesel will drop in price in the month of November, driven by a fall in international prices and the exchange rate, although biodiesel prices continue to counteract this downward trend.

The El Niño weather phenomenon has led to a sharp increase in demand for natural gas, and industries on the Caribbean coast are calling for government intervention due to the deficit and soaring prices.

The Minister of Mines and Energy Tomás González met with regional leaders from the Nariño Department and the National Direction of Hydrocarbons and said that fuel prices in regions should remain stable through the end of November at least, and reassured there would be supply.

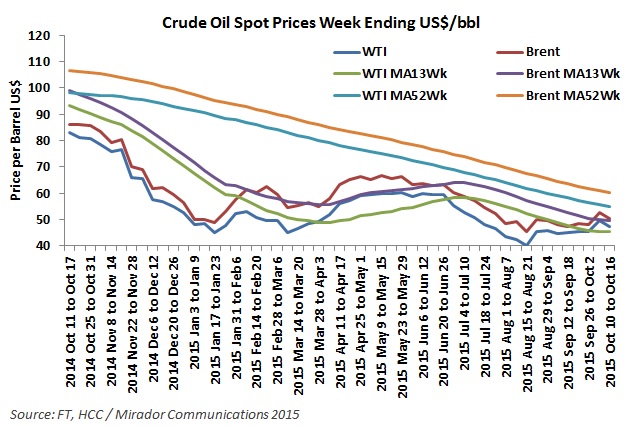

A national paper consulted with business leaders on where they thought the oil price would settle in the short term. And with words of caution and uncertainty, the response was that it would hover around US$50/barrel. Maybe.

Globally there are 20M natural gas vehicles (NGVs) with over 500,000 of these in Colombia, according to Pablo Roda, a spokesperson with the Natural Gas Association (Naturgas) who spoke at the Colfecar transportation congress.

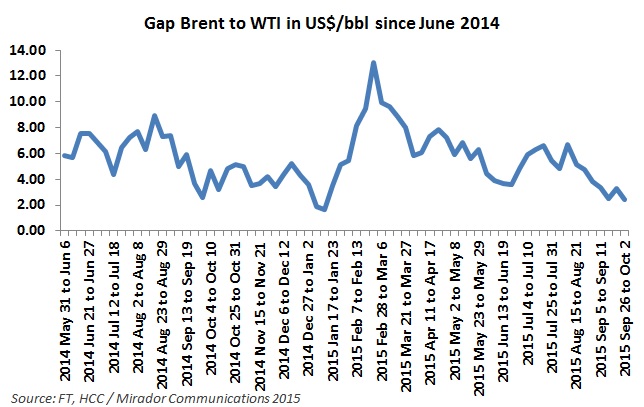

Ecopetrol is following the lead of other producers in Latin America and OPEC members by importing light crude from Nigeria and Russia to mix with its heavy crude production and fetch a better international price, fostered by a shrinking gap between the Brent and WTI prices.

The fact that biofuels do not need to be refined from crude, which first must be found and extracted, plus their environmental benefits make them a strategic bet that Colombia must consider, says the president of the biofuels association, (Fedebiocombustible) Jorge Bendeck.

Fuel retailer Terpel says that it is investing to innovate its service stations in order to create more loyal customers, and despite the fall in oil prices and a weak Colombian peso, its president Sylvia Escovar expects revenue growth this year of 10%.

The Ministry of Mines and Energy (MinMinas) says gasoline prices will fall in October based on a drop in its international price, although the exchange rate and biofuel prices meant diesel increased slightly, and also countered the decrease of gasoline.